Imagine a world where anyone can own a piece of an autonomous robot fleet, earning real-world income as these machines deliver coffee, clean streets, or transport goods. Thanks to the convergence of DePIN (Decentralized Physical Infrastructure Networks), blockchain, and AI robotics, this vision is quickly becoming reality. Fractional robot ownership models are at the heart of this revolution, opening doors for individuals and communities to participate in – and profit from – the machine-driven economy.

Why Fractional Ownership is Transforming DePIN Robotics

Traditional robotics deployment required massive capital and centralized control. But in the DePIN era, tokenization is breaking down barriers. Platforms like PinLink have pioneered ways to convert physical robots into digital shares or tokens. These tokens can be bought and traded by investors worldwide, giving each holder a proportional claim on the robot’s revenue streams and future appreciation (source).

This approach does more than democratize access; it injects much-needed liquidity into robotics markets that were once reserved for big corporations. Now, someone with $100 can co-own an autonomous delivery bot or even a share of an entire robo-café fleet.

The Rise of MachineDAOs: Decentralizing Robot Management

At the core of fractional ownership lies a new kind of governance: the MachineDAO. Pioneered by innovators like XMAQUINA on the peaq network, MachineDAOs allow token holders to collectively make decisions about robot operations and upgrades (source). This creates a transparent system where profits and responsibilities are shared among participants rather than funneled to a single corporate entity.

XMAQUINA’s vision goes even further. Their upcoming launchpad (slated for late 2025) aims to enable tokenization not just for individual robots but for entire fleets. Think fractional ownership of cleaning robots in airports or delivery drones serving urban neighborhoods – all coordinated by decentralized communities rather than top-down management.

Top Benefits of Fractional Robot Ownership in DePIN

-

Automated Revenue Sharing: Token holders automatically receive a portion of the income generated by robots, as seen with XMAQUINA’s robo-café on the peaq network, making passive income from real-world robot operations seamless and transparent.

-

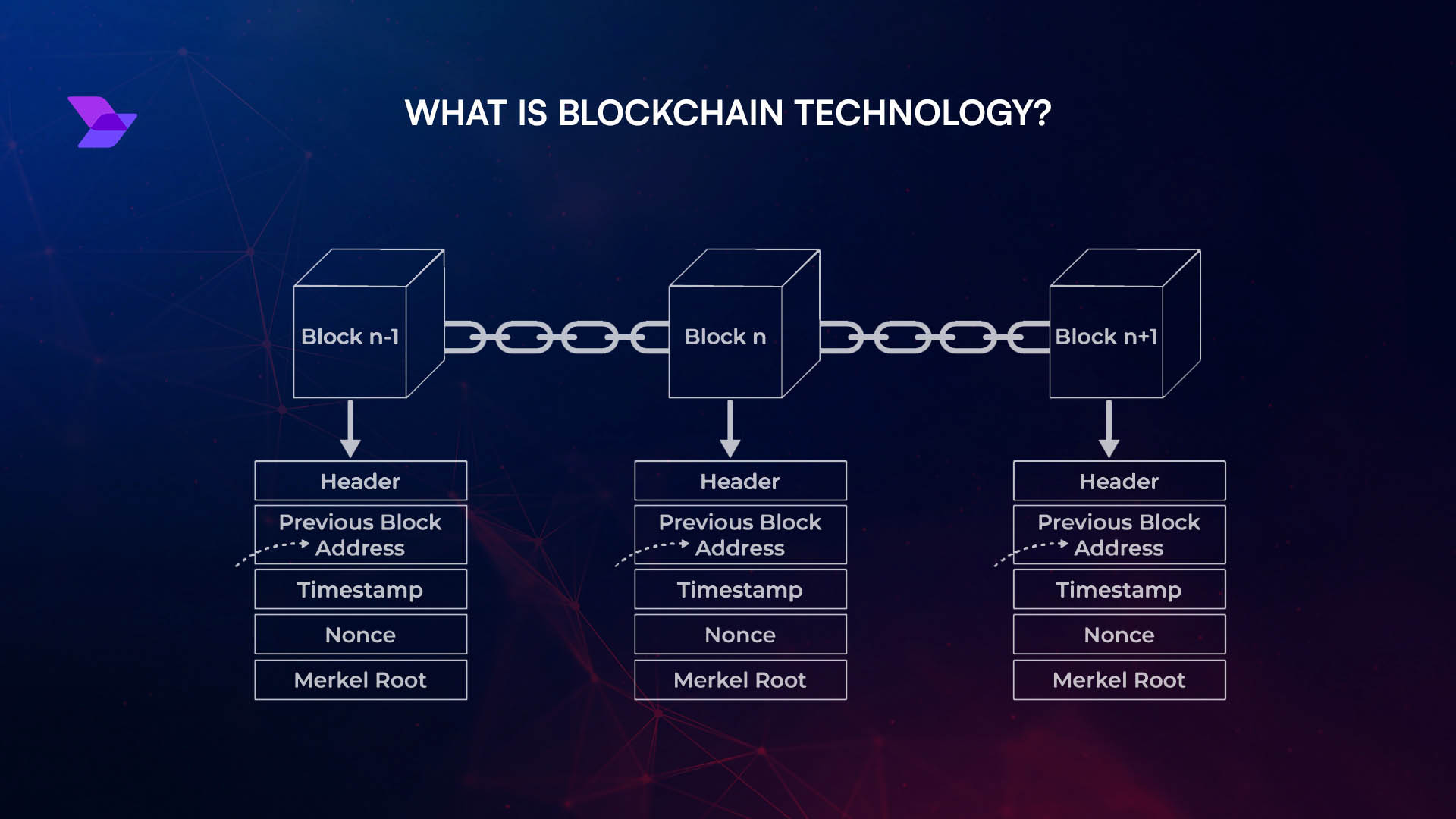

Transparent and Secure Ownership: Blockchain integration ensures all ownership records are immutable and easily auditable, providing trust and security for stakeholders in DePIN ecosystems.

-

Community-Driven Decision Making: With DAOs like XMAQUINA’s MachineDAO, collective ownership means that key decisions—such as upgrades or redeployment—are made democratically by token holders, ensuring community alignment.

-

Enhanced Liquidity and Flexibility: Tokenized shares of robots can be traded on secondary markets, allowing investors to easily enter or exit positions and making robot ownership more dynamic than traditional asset models.

-

Scalable and Efficient Operations: Integrating fractional ownership with DePIN protocols (e.g., Arkreen, DIMO) optimizes resource allocation and enables robots to be deployed wherever they’re most needed, maximizing network efficiency.

-

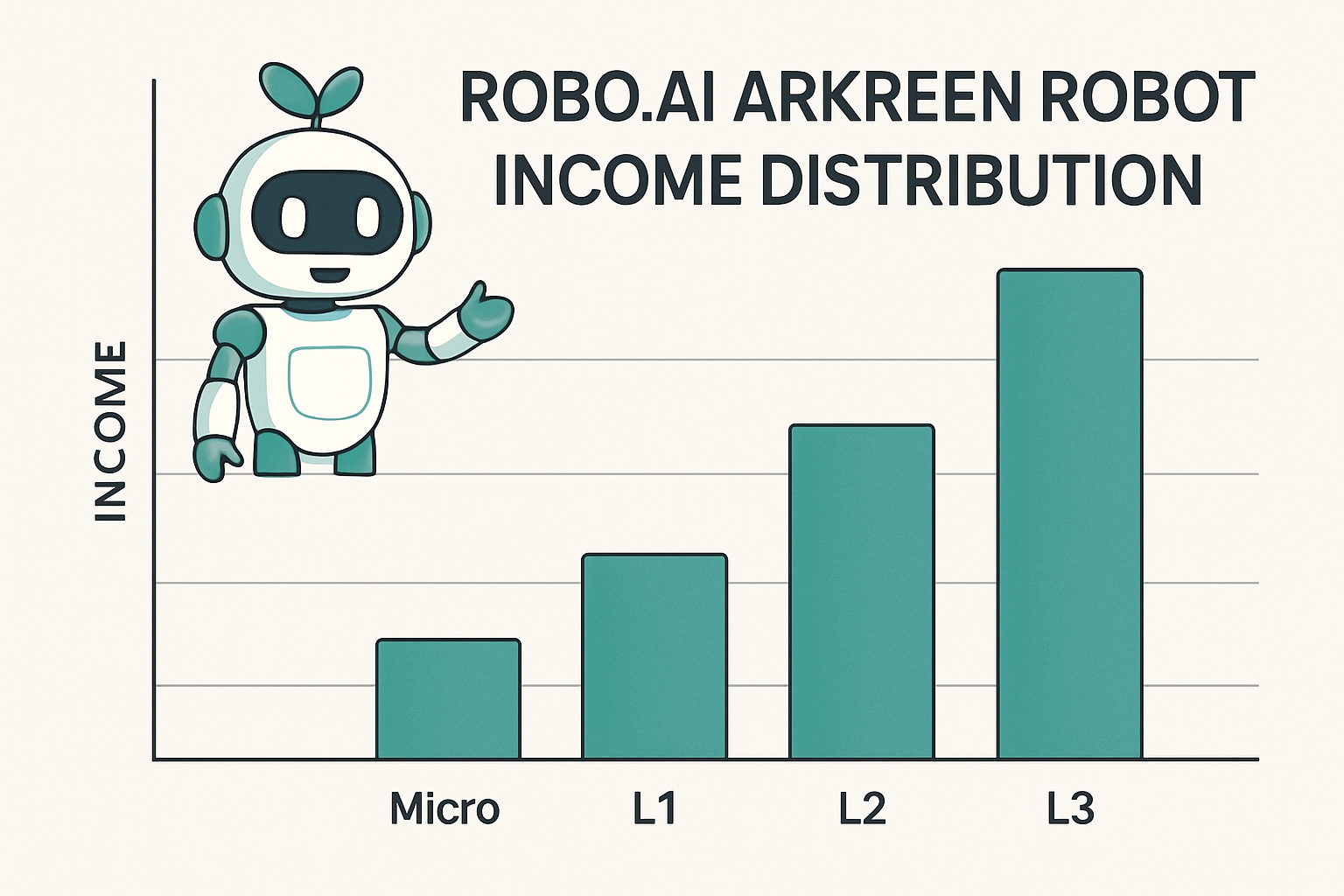

Real-World Income Generation: Projects like Robo.ai and Arkreen demonstrate how autonomous robots can generate and distribute real-world revenue to fractional owners, fostering a new era of machine-driven economies.

Integration with DePIN Ecosystems: Real-World Impact

The magic happens when these fractional models plug into broader DePIN networks. By leveraging blockchain’s transparency and programmability, platforms ensure every transaction – from revenue distribution to secondary market trading – is automated and auditable (source). This not only optimizes resource allocation but also allows anyone to participate in high-value infrastructure projects that were previously out of reach.

Take Robo. ai’s partnership with Arkreen as an example: they’re integrating intelligent devices into Arkreen’s DePIN network so that data generated by autonomous vehicles can be monetized efficiently through Web3 economic models. The result? A self-reinforcing cycle where robots earn income, distribute it among token holders, and use part of it for maintenance or upgrades – all governed by smart contracts.

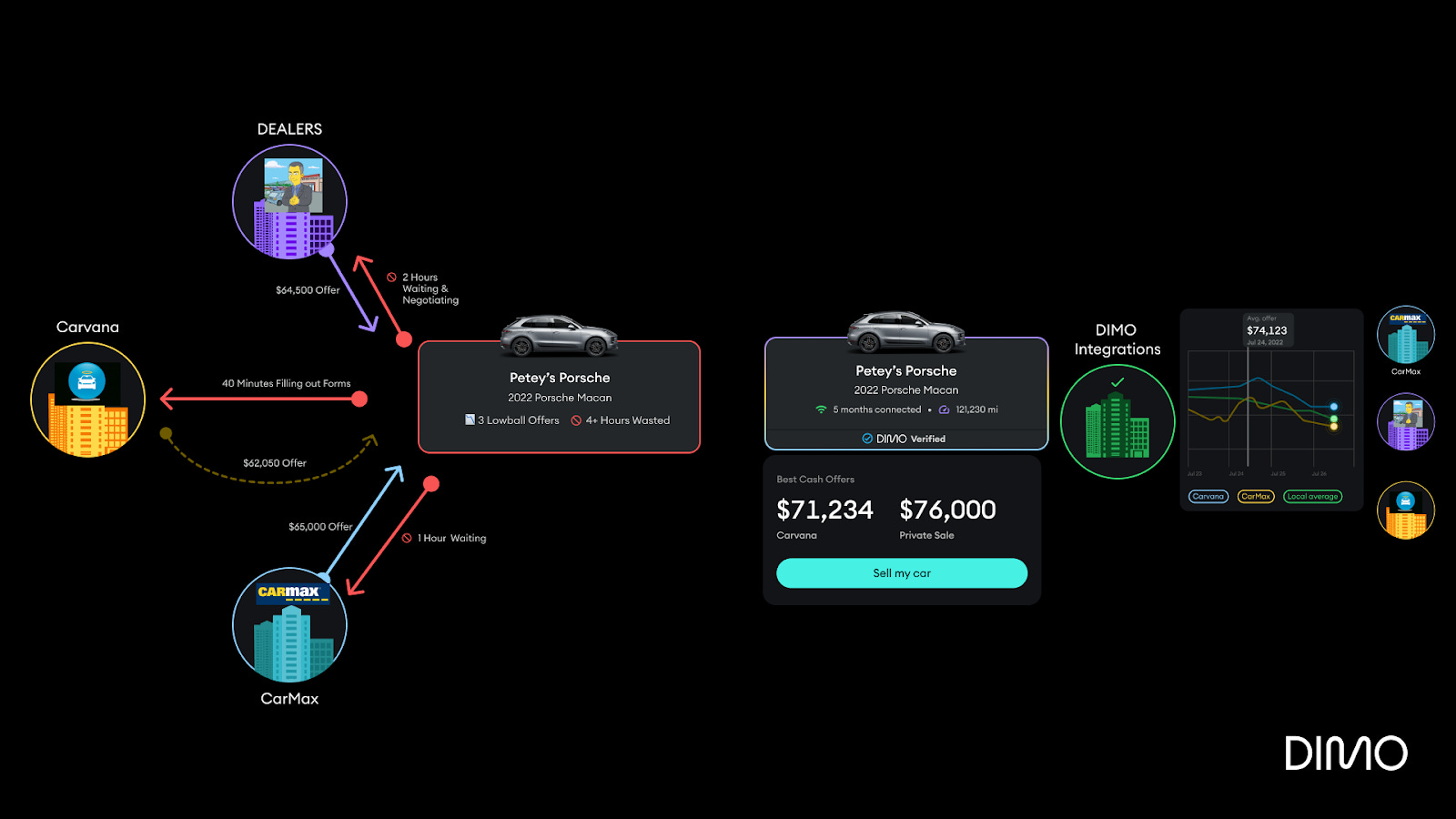

Other projects are racing to capture this new paradigm. OWNAI, for instance, is positioning itself as the first “AI Automated Asset Marketplace, ” where users can buy fractionalized stakes in income-generating robots and autonomous vehicles. This isn’t science fiction: it’s a living marketplace where ownership and yield flow directly to contributors, not just VC funds or conglomerates. DIMO is similarly pioneering decentralized vehicle networks, connecting cars and robots through tokenized incentives, further blurring the line between digital assets and real-world machines.

What’s most exciting is how these models empower communities. Instead of passively consuming automation, local groups can now pool resources to deploy fleets tailored to their needs, whether that’s street-sweeping bots in a city district or a shared network of delivery drones for rural logistics. By aligning economic incentives with local priorities, DePIN robotics unlocks new levels of efficiency and resilience.

Risks, Challenges, and the Road Ahead

No revolution comes without its hurdles. Security is paramount: smart contracts must be bulletproof to prevent exploits that could siphon off robot-generated revenue. Regulation looms large as well, fractional robot ownership sits at the intersection of fintech, securities law, and labor policy. Projects like XMAQUINA and Arkreen are navigating these waters carefully by building on compliant blockchains and fostering transparent governance.

Another challenge is ensuring equitable participation. Without careful design, whales could dominate voting power within MachineDAOs or secondary markets could become speculative bubbles detached from real utility. The best DePIN projects are experimenting with quadratic voting or staking-based rewards to keep communities healthy and engaged.

The Future of Fractional Robot Ownership

The coming years will see massive growth in fractional robot ownership, especially as tokenization tools mature and regulatory clarity improves. As more robots come online, from eVTOL air taxis to micro-fulfillment bots, the opportunity for everyday people to become co-owners will only expand.

If you’re curious about participating in this machine-driven economy, now’s the time to dive in. Explore emerging platforms like PinLink or follow trailblazers like XMAQUINA and Robo. ai as they shape the next wave of decentralized automation (source). The future isn’t just automated, it’s owned by all of us.

Top Projects Driving Fractional Robot Ownership

-

XMAQUINA: XMAQUINA is pioneering collective robotics ownership with its MachineDAO on the peaq network. Their tokenized robo-café lets community members invest in and share profits from real-world autonomous robots, showcasing a working model for fractional ownership in DePIN ecosystems.

-

PinLink: PinLink enables asset owners to tokenize autonomous robots and other DePIN assets, allowing investors to buy digital shares and earn a portion of the generated income. This platform is at the forefront of democratizing access to robotics investments.

-

Robo.ai & Arkreen: Through their partnership, Robo.ai and Arkreen are integrating intelligent robots into the Arkreen DePIN network, creating new opportunities for data monetization and collaborative robot ownership using Web3 economic models.

-

OWNAI: OWNAI brands itself as the first AI Automated Asset Marketplace, offering tokenized ownership of real-world, income-generating robots and autonomous vehicles. This platform is making it easier for users to invest in and benefit from robotic automation.

-

DIMO: DIMO is a leading DePIN protocol for vehicles, enabling tokenized, fractional ownership and data monetization for fleets of cars and potentially other autonomous machines, bridging the gap between blockchain and real-world robotics.