The seismic shift in AI infrastructure is not coming from cloud titans, but from the grassroots up: tokenized GPU marketplaces are unleashing a new era for decentralized AI compute. By 2025, DePIN (Decentralized Physical Infrastructure Networks) is projected to reach a staggering $50 billion market valuation, with GPU-centric networks leading the charge. These platforms are transforming idle hardware into programmable, revenue-generating assets, using tokenization to democratize, incentivize, and coordinate compute at a global scale.

Tokenized GPU Marketplaces: The Engine of Decentralized AI Compute

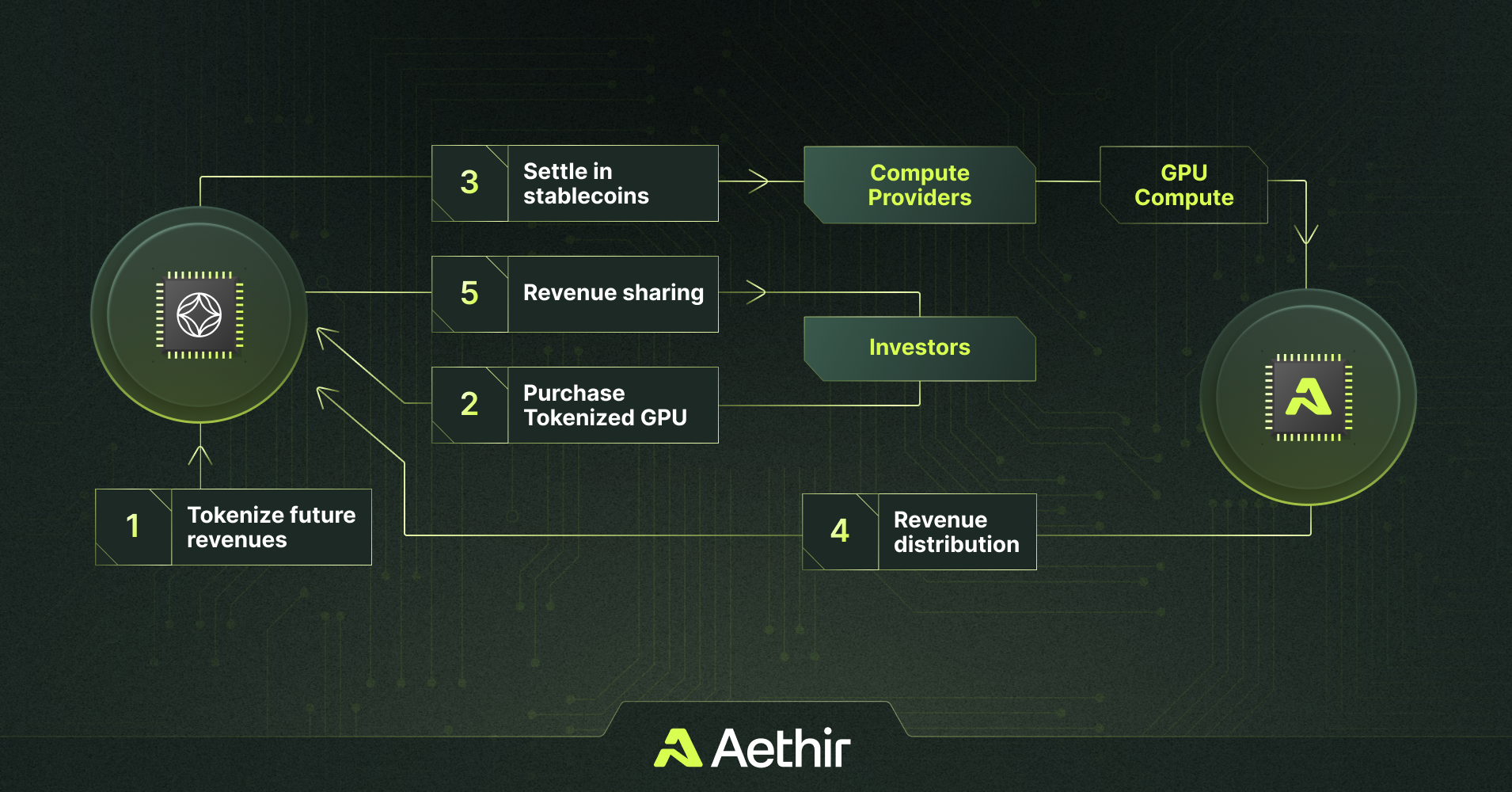

At the heart of this disruption are tokenized GPU marketplaces like GAIB in partnership with Aethir and Node AI’s GPU NFT marketplace. These platforms allow investors and developers to purchase fractional ownership of enterprise-grade GPUs, represented as digital tokens or NFTs. In return, holders gain access to compute income, platform rewards, and exposure to the programmable hardware yield generated by AI workloads.

Unlike traditional cloud providers, where access is pay-as-you-go and tightly controlled, tokenized GPU networks offer transparent, trustless, and on-demand compute. This model is upending the status quo, making high-performance AI infrastructure accessible to startups, researchers, and communities previously priced out of the market.

“Tokenization is not just about ownership, it’s about liquidity, governance, and programmable economics that align incentives across the entire AI compute supply chain. “

How Tokenization Unlocks Hardware Liquidity and Programmable Yield

The genius of the tokenized GPU marketplace is that it turns a traditionally illiquid, depreciating asset into a liquid, yield-generating instrument. Platforms like GAIB and Node AI enable anyone to buy, sell, or trade shares of physical GPUs, much like how stocks or commodities are traded on financial markets. This unlocks global liquidity for hardware owners and creates new revenue streams for participants via:

Key Benefits of Tokenized GPU Marketplaces

-

Fractional GPU Ownership for Investors: Platforms like GAIB and Aethir enable investors to purchase tokenized shares of enterprise-grade GPUs, providing access to future compute income and platform rewards through transparent, blockchain-based mechanisms.

-

Democratized Access to AI Compute for Developers: Tokenized GPU networks such as Node AI allow AI developers to access powerful, distributed GPU resources on-demand, making large-scale model training and inference more affordable and scalable.

-

Efficient Utilization of Idle Hardware for Providers: Solutions like GPUAI incentivize hardware providers to contribute unused GPU capacity to decentralized networks, turning idle resources into revenue streams and reducing overall hardware waste.

-

Enhanced Liquidity and Transparency via Blockchain: By leveraging blockchain technology, tokenized GPU marketplaces ensure transparent transactions, verifiable ownership, and liquid trading of GPU assets, reducing barriers to entry and exit for all participants.

-

Decentralized Governance and Reduced Centralization Risks: Platforms such as Render Network and Akash employ decentralized governance models, empowering community stakeholders and mitigating risks associated with centralized compute providers.

Token holders are rewarded not only by the appreciation of their assets, but also by a share of the revenue generated from AI model training, inference, and other high-demand compute tasks. This programmable yield is secured via smart contracts, governed by transparent rules, and often distributed in real time.

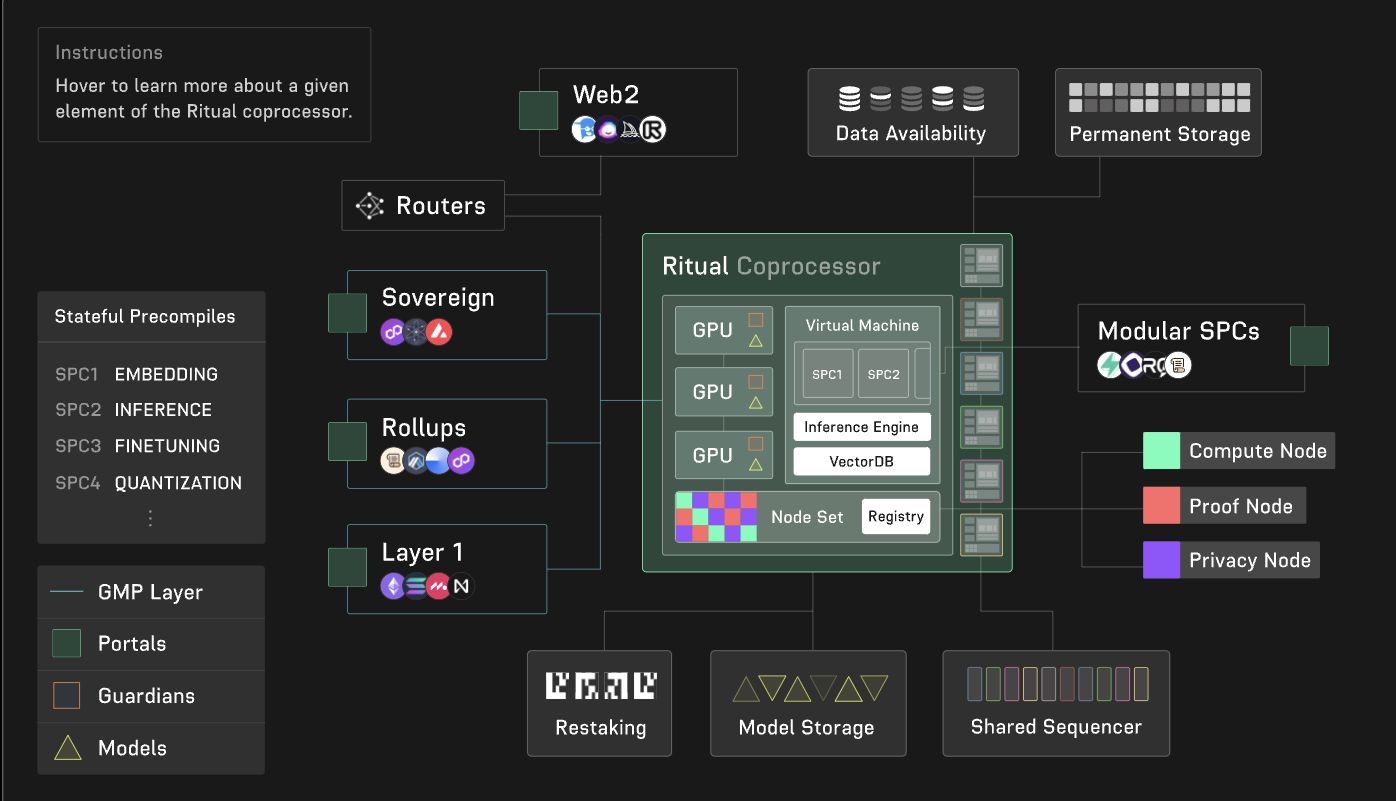

Proof-of-Compute: Ensuring Trust and Fairness in Decentralized AI

One of the most critical innovations enabling this new paradigm is Proof-of-Compute. Unlike traditional Proof-of-Work or Proof-of-Stake, Proof-of-Compute protocols verify that actual AI computations have been performed on the network’s GPUs. This ensures fairness, prevents fraud, and aligns rewards with real-world utility.

For example, AI Pulse’s GDePIN network has introduced a proprietary Proof-of-Compute protocol to verify work completion and incentivize honest participation. These mechanisms are essential for maintaining trust in decentralized AI compute networks, especially as they scale to handle enterprise-grade workloads.

Democratizing Access: From Centralized Clouds to Community-Owned Compute

The impact of tokenized GPU marketplaces extends far beyond technical innovation. By aggregating individual GPU resources through token incentives, decentralized networks are alleviating the global GPU shortage and providing cost-effective alternatives to traditional cloud giants. AI builders can now train models, run inference, and scale applications without being locked into proprietary ecosystems or unpredictable pricing structures.

This democratization is already fueling the next generation of AI applications, from decentralized LLM inference to blockchain-based machine learning. For a deeper exploration of how these networks are transforming costs and accessibility, see our analysis here.

Tokenized GPU marketplaces are also redefining how value circulates in the AI compute economy. Instead of profits consolidating with a handful of hyperscalers, rewards are distributed to a global network of contributors, hardware owners, node operators, and developers, based on verifiable output. This shift is powering an entirely new class of programmable economics where every participant can benefit from the surging demand for AI compute.

Transparency is another core advantage. Every transaction, from compute job execution to revenue distribution, is recorded on-chain, allowing for real-time auditing and community governance. This transparency is critical as DePIN AI infrastructure scales to support applications in finance, healthcare, autonomous vehicles, and beyond. The ability to trace every token movement and computation not only builds trust but also enables rapid iteration on incentive models.

Challenges Ahead: Scalability, Regulation, and Ecosystem Fragmentation

Despite their promise, tokenized GPU marketplaces face hurdles. Scalability remains a technical challenge as networks must accommodate increasingly complex workloads without sacrificing speed or reliability. Regulatory uncertainty around tokenized assets and securities law could impact how these platforms operate globally. Additionally, fragmentation across protocols risks diluting network effects unless interoperability standards emerge.

Nevertheless, the pace of innovation has been relentless. Projects like Akash, Render Network, and newcomers such as GAIB and Node AI are actively experimenting with governance frameworks, cross-chain compatibility, and new forms of programmable hardware yield. The race is on to build robust decentralized GPU networks that can rival, and eventually surpass, centralized incumbents in performance and cost-efficiency.

What’s Next: Programmable Compute Markets at Global Scale

The trajectory is clear: by 2025 and beyond, programmable compute markets will be integral to the digital economy. Tokenized GPU marketplaces are already unlocking new paradigms for hardware utilization, fractionalizing ownership, increasing liquidity, and aligning incentives through crypto-powered compute rewards.

For investors seeking exposure to the backbone of next-generation AI infrastructure or developers building at the bleeding edge of machine learning, these platforms offer unparalleled opportunity, and risk. Due diligence into protocol security, governance models, and real-world demand for decentralized AI compute remains essential.

Top Tokenized GPU Marketplaces Shaping DePIN AI in 2025

-

Aethir: Aethir operates a decentralized GPU cloud marketplace, enabling enterprises and AI developers to access and monetize distributed GPU resources through tokenized models. Their partnership with GAIB allows investors to purchase tokenized shares of enterprise-grade GPUs, unlocking revenue from compute income and platform rewards. Learn more.

-

Node AI: Node AI’s GPU NFT Marketplace tokenizes physical GPU assets into tradable NFTs, providing users with direct, fractional ownership and streamlined access to high-performance computing for AI workloads. The platform emphasizes transparency and liquidity via blockchain-based asset management. Learn more.

-

Render Network (RNDR): Render Network connects creators and AI developers with idle GPU compute power globally. By tokenizing compute resources via the RNDR token, the platform facilitates efficient, decentralized rendering and AI model training at scale.

-

Akash Network: Akash Network is a decentralized cloud computing marketplace that allows users to lease GPU and CPU resources using blockchain-based smart contracts. Its open marketplace structure and tokenized incentives make it a key player in the DePIN AI infrastructure ecosystem.

-

GPUAI: GPUAI is building a global, tokenized AI compute layer by aggregating idle GPUs and making them available for AI model training, inference, and data streaming. The platform leverages blockchain for trustless, on-demand access and incentivizes GPU providers with its native token.

As programmable hardware yield becomes a mainstream financial primitive and Proof-of-Compute protocols mature, expect further disruption across industries reliant on high-performance computing. The days when access to advanced AI was gated by capital or geography are fading fast; community-owned decentralized GPU networks are opening doors for innovators worldwide.

If you’re ready to dive deeper into how these trends will shape the future of decentralized AI compute, and where opportunities lie, explore our related coverage here.