In 2025, AI-driven DePIN networks are no longer a theoretical construct but a rapidly maturing reality. The fusion of decentralized physical infrastructure (DePIN) with advanced machine learning is creating a new class of digital-physical systems: infrastructures that are autonomous, self-optimizing, and economically incentivized via blockchain protocols. As the sector’s market capitalization surges past $50 billion and over 350 tokens now represent distinct infrastructure services, this convergence is fundamentally altering how industries deploy and manage critical resources.

The Core Mechanisms: How AI Supercharges DePIN Networks

At the heart of this transformation lies the synergy between distributed ledger technology and artificial intelligence. DePINs coordinate the deployment and operation of physical assets, such as edge compute nodes, IoT devices, autonomous vehicles, or wireless access points, using smart contracts and token-based incentives. AI enhances this model by enabling predictive maintenance, dynamic demand allocation, and real-time optimization at the network edge.

Recent advances underscore this trend:

- Bittensor (TAO)’s collaborative subnets allow multiple AI models to interact within a decentralized environment, enabling self-organizing intelligence at scale.

- The Edge Agentic AI Framework for O-RAN introduces autonomous agents that continuously optimize radio access networks in real time, a critical capability for next-generation telecom infrastructure.

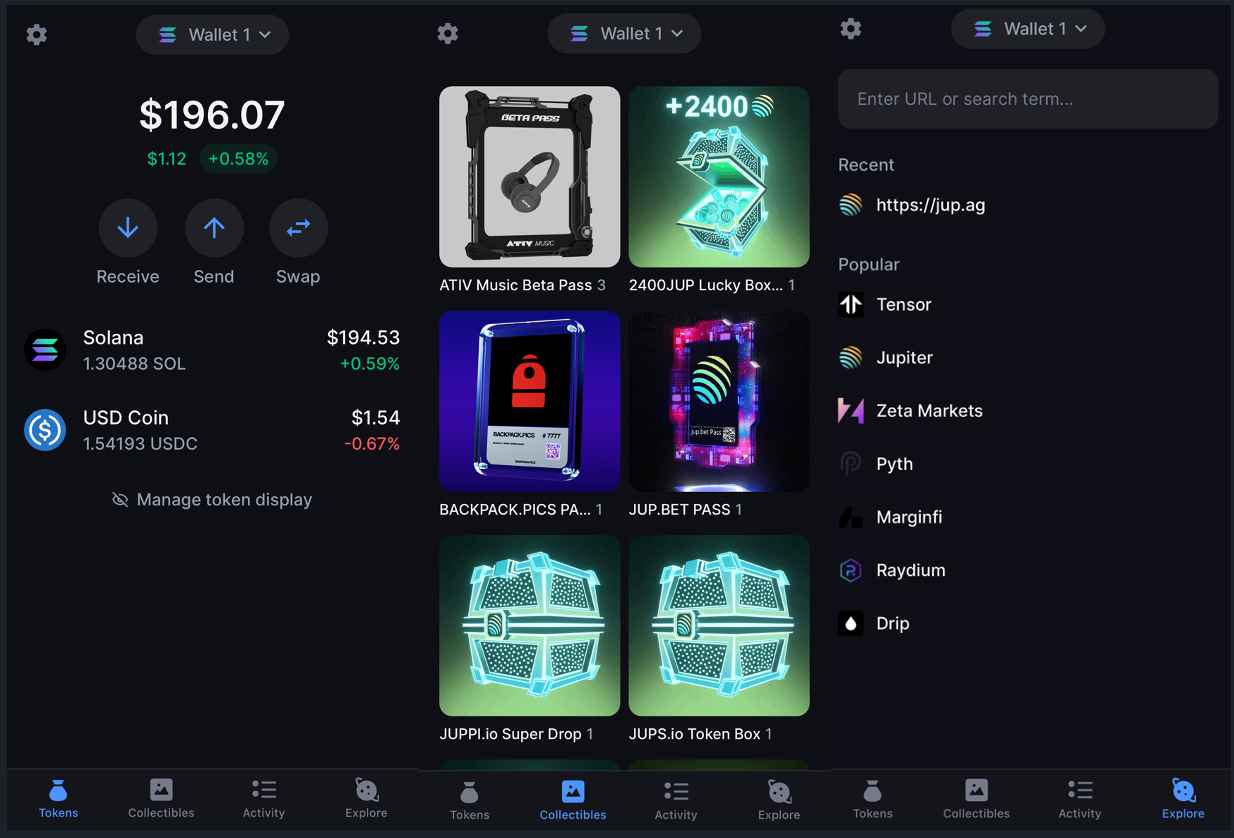

- Solana-powered DePIN platforms, such as Render Network and Nosana, provide scalable GPU resources for distributed AI training and inference, drastically reducing costs for developers while maintaining high throughput.

This architecture creates a feedback loop: as more intelligent agents join the network, they contribute data and computational power while being rewarded via dynamic tokenomics. The result is an infrastructure that not only grows organically but also optimizes itself in response to shifting demand patterns and operational anomalies.

Pioneering Use Cases: From Machine Economy to Predictive Maintenance

The implications of these developments are profound across multiple sectors:

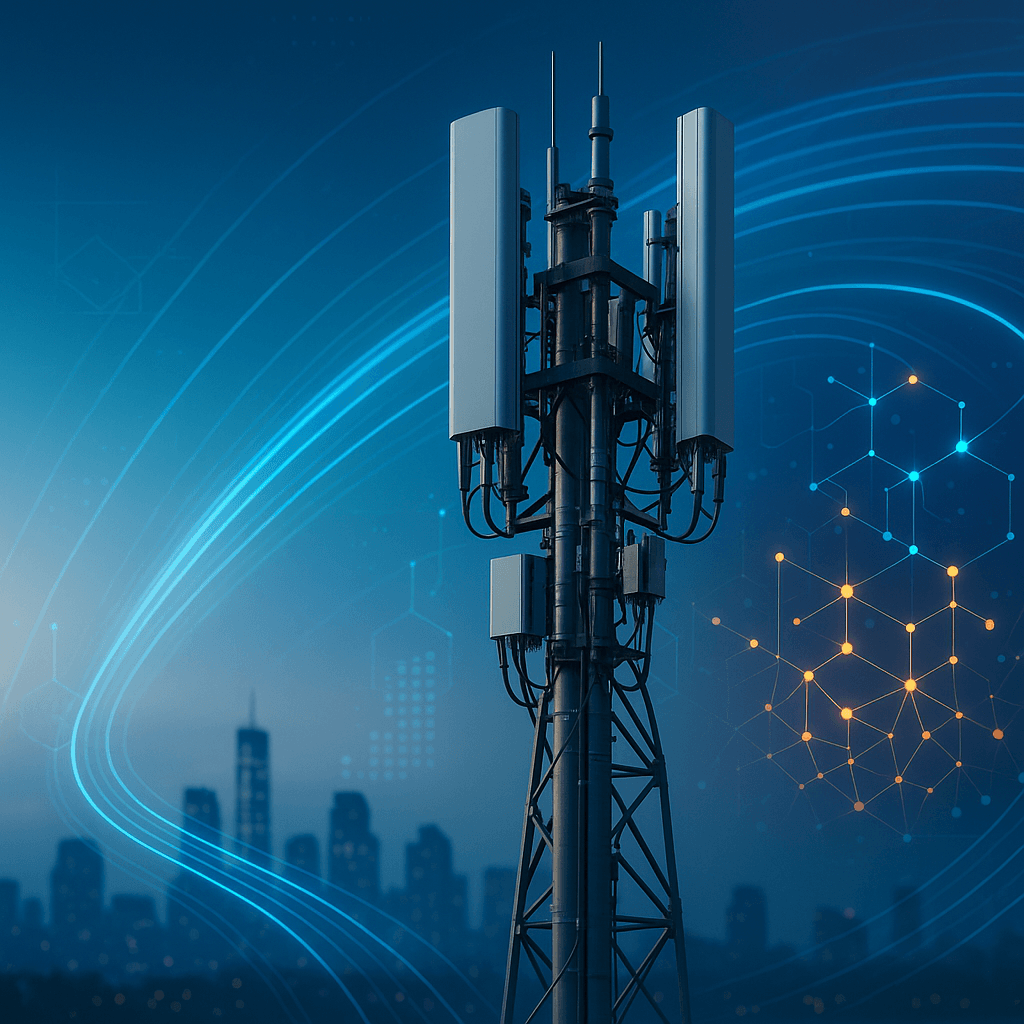

- Telecommunications: Autonomous agents manage spectrum allocation and backhaul optimization in real time, supporting seamless 6G coverage through frameworks like the AI Agent Access (A³) Network.

- Transportation: Projects such as Robo. ai’s partnership with Arkreen demonstrate how eVTOLs and autonomous vehicles can plug into DePINs to monetize their operations while dynamically optimizing routing, charging schedules, and maintenance cycles using on-chain machine learning models.

- Energy and Edge Compute: Decentralized marketplaces allow energy producers or GPU node operators to offer excess capacity directly to consumers or applications, AI algorithms match supply with demand instantaneously based on predictive analytics.

This shift enables a true machine economy: devices transact value autonomously based on performance metrics or service-level agreements embedded in smart contracts. Blockchain ensures trust-minimized settlements while AI guarantees optimal resource utilization, a paradigm shift from static infrastructure management to dynamic, self-sustaining networks.

The Rise of Dynamic Tokenomics in Self-Optimizing Networks

A defining feature of these systems is their use of dynamic tokenomics. Unlike traditional IT procurement or centralized SaaS models, DePIN networks incentivize participation through real-time rewards calibrated by algorithmic governance. For example:

- Edge compute nodes receive higher payouts during peak demand periods or when servicing mission-critical workloads identified by AI-driven monitoring tools.

- Sensors or data providers earn tokens proportional to the quality and utility of their contributions, verified by federated learning models running across the network.

- User access fees, staking mechanisms, and slashing conditions are all dynamically adjusted based on network health metrics collected autonomously by intelligent agents.

This approach not only maximizes efficiency but also creates robust economic incentives for continual improvement, each participant has skin in the game as the network evolves toward optimal performance.

As these networks scale, the interplay between AI and decentralized governance is unlocking new frontiers in infrastructure resilience and adaptability. AI-driven analytics enable real-time anomaly detection, fraud prevention, and automated remediation, capabilities that are prohibitively complex or costly in legacy systems. Moreover, the modularity of DePIN protocols means that new hardware, service providers, or even entire subnets can be onboarded seamlessly without centralized approval bottlenecks.

Industry leaders are converging on this vision at events like Breaking DePIN 2025 in Zurich, where innovators showcase autonomous fleets, decentralized wireless networks, and AI-powered logistics solutions. The consensus is clear: AI-powered blockchain infrastructure is not just reducing operational costs but fundamentally altering the economics of infrastructure deployment worldwide.

Challenges Ahead: Security, Interoperability, and Regulatory Dynamics

Despite the momentum, several technical and regulatory challenges remain. Security in autonomous decentralized infrastructure is paramount, AI agents must be robust against adversarial attacks and collusion risks. Ongoing research focuses on cryptographic proofs for agent behavior and zero-knowledge attestations to ensure trust without sacrificing privacy.

Interoperability is another frontier. With over 350 tokens representing diverse services in the DePIN sector as of 2025 (depinscan. io), seamless cross-network coordination becomes essential. Protocols are emerging to standardize data exchange and service discovery across heterogeneous DePINs, enabling composite applications that span energy grids, compute fabrics, and mobility platforms.

Regulatory clarity will also shape adoption trajectories. As machine economy AI systems increasingly transact autonomously using programmable assets, questions around liability, taxation, and compliance become more acute. Industry consortia are engaging with policymakers to develop frameworks that balance innovation with risk mitigation.

Key Use Cases for Self-Optimizing DePIN Networks in 2025

-

Autonomous Vehicles Monetizing Routes via Arkreen DePIN: Robo.ai and Arkreen’s collaboration enables eVTOLs and self-driving cars to connect to DePIN networks, sharing real-time data and earning rewards for efficient route optimization and service contributions.

-

Edge Compute Nodes Adjusting Rewards Dynamically: Platforms like Render Network and Nosana, powered by Solana, use AI to dynamically allocate GPU resources and adjust node rewards based on real-time demand, ensuring optimal compute distribution and cost efficiency.

-

Decentralized Energy Markets Balancing Supply and Demand: AI-driven DePINs facilitate decentralized energy trading, where smart contracts and machine learning algorithms autonomously balance grid supply and demand, optimizing energy flows and incentivizing sustainable production.

-

Self-Optimizing 6G Network Coverage with AI Agent Access (A³) Network: The A³ Network leverages multi-agent AI to autonomously expand and optimize 6G wireless coverage, enabling real-time scaling and efficient resource management across diverse environments.

-

Autonomous O-RAN Optimization via Edge Agentic AI Framework: Open Radio Access Networks (O-RAN) integrate edge-based AI agents for autonomous network optimization, enabling real-time self-configuration and adaptive performance in complex telecom infrastructures.

What’s Next? The Road to Full Autonomy

The trajectory for self-optimizing DePIN networks points toward increasing autonomy at every layer, from device-level decision-making to macro-scale resource orchestration across continents. Expect continued advances in multi-agent reinforcement learning frameworks like A³ Network for 6G coverage and further integration of predictive maintenance algorithms into physical infrastructure management.

The next wave will see deeper convergence between on-chain AI agents and off-chain data feeds (oracles), facilitating richer forms of automation: smart cities where traffic lights negotiate bandwidth with autonomous vehicles; power grids that self-balance based on micro-level consumption forecasts; or global GPU pools dynamically priced by real-time compute demand.

The market’s $50 billion capitalization milestone signals robust investor confidence, but it is the agility of these networks to adapt autonomously that may ultimately define their value proposition as critical digital public goods for the coming decade.