In 2025, gaming rigs sitting dormant between sessions represent untapped capital. High-end GPUs, once optimized solely for ray-traced visuals and frame-rate chases, now hold the key to DePIN GPU monetization 2025. By transforming idle gaming GPUs into nodes for decentralized AI compute, everyday gamers can tap into a burgeoning market where AI developers scramble for affordable horsepower. This shift isn’t just about passive earnings; it’s a strategic pivot toward owning a slice of the AI infrastructure revolution.

Why Idle GPU DePIN is Poised for Explosive Growth

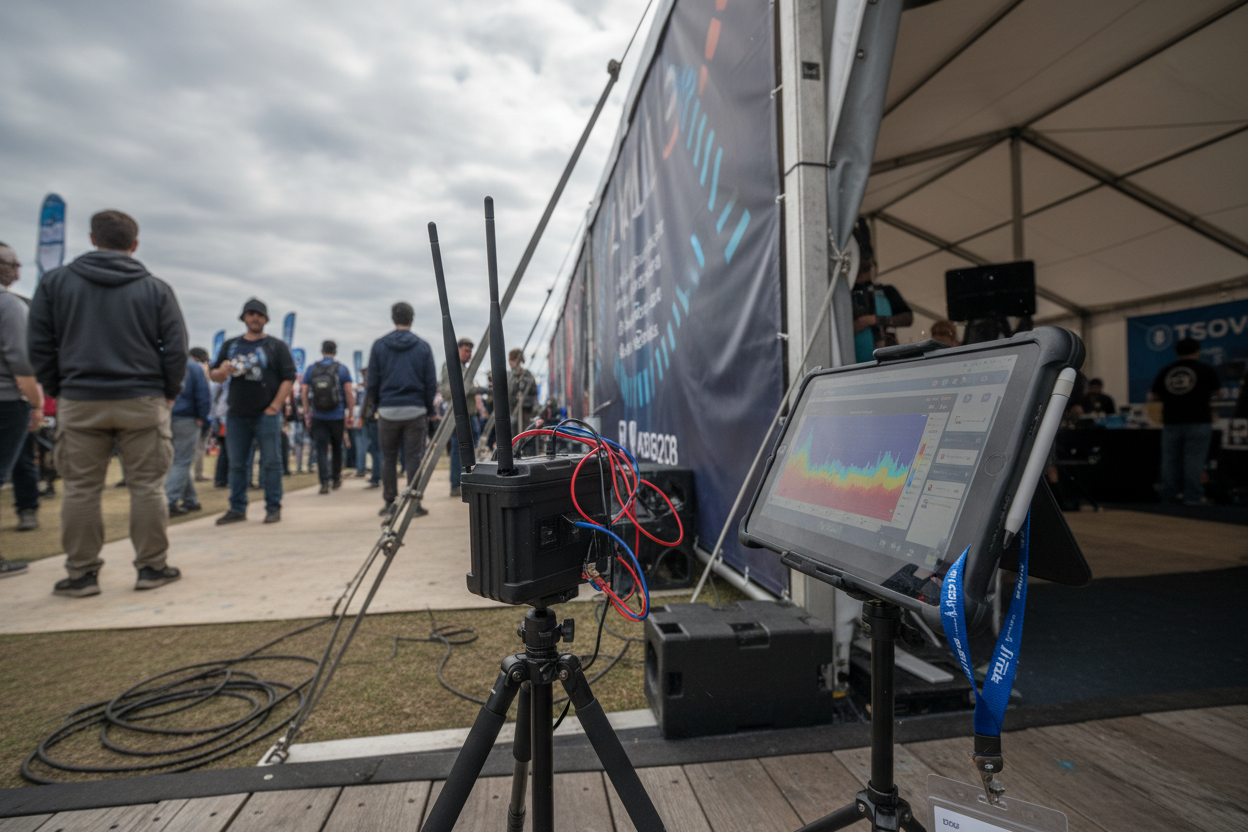

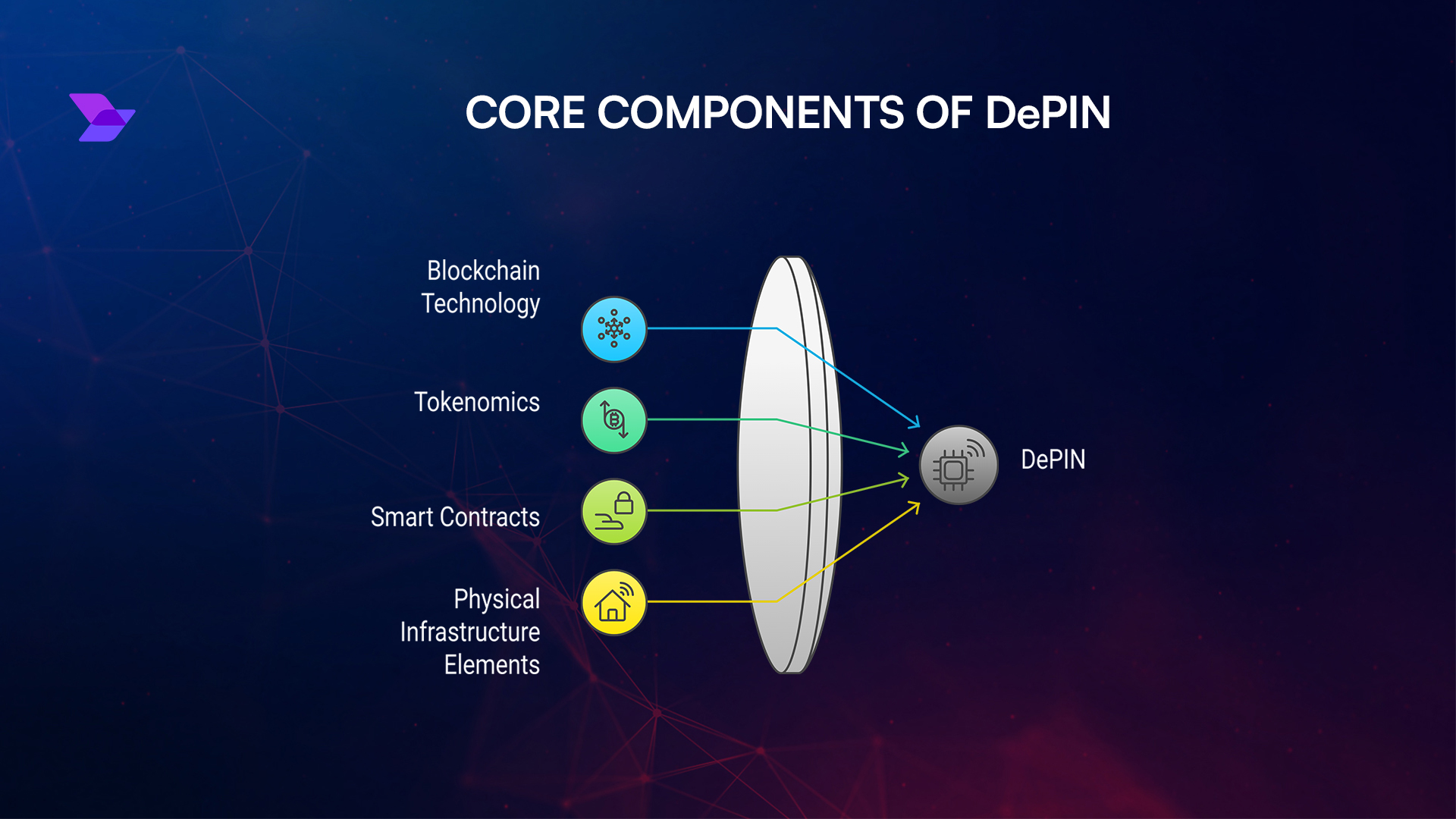

The demand for AI compute has outstripped centralized cloud capacity, driving costs skyward and bottlenecks deeper. Enter DePIN: decentralized physical infrastructure networks that crowdsource GPU power from willing participants. Platforms like Nosana and Aethir exemplify this, pooling idle GPU DePIN resources into scalable grids. Nosana, on Solana, lets users list GPUs for AI workloads, earning $NOS tokens without the friction of traditional providers. Aethir, meanwhile, boasts over 430,000 GPU containers worldwide, catering to enterprise AI inference and gaming at scale.

What sets 2025 apart? Maturing tokenomics and refined node software minimize downtime while maximizing uptime earnings. Gamers with NVIDIA RTX 40-series or AMD RX equivalents can expect competitive yields, often surpassing staking alone. Yet, this isn’t hype-fueled speculation; it’s grounded in real utility as AI models grow hungrier for distributed inference.

Top Platforms Turning Gaming PCs into AI Compute Nodes

Selecting the right network demands a strategic lens. Here’s where gaming PC AI compute nodes shine brightest:

Key DePIN GPU Platforms

-

DePINed App: Share idle GPUs and bandwidth for hourly payouts in the DePIN SuperCloud Network. Visit site

-

Nosana: Solana-based grid to earn $NOS tokens by contributing idle GPUs for AI workloads. Details

-

Aethir: Enterprise-scale GPU pools with 430K+ containers across 94 countries for AI and gaming. Explore

-

POPAI: Peer-to-peer network earning $POPCOIN on NVIDIA, AMD, or Intel GPUs. Read more

DePINed App stands out for its plug-and-play simplicity, sharing bandwidth and compute with AI firms via hourly micropayments. POPAI extends accessibility to AMD and Intel GPUs, fostering a community-owned grid where earnings fund further staking. Render Network, a veteran in decentralized rendering, continues to reward RNDR for GPU lending, bridging creative workloads with AI.

These aren’t equal opportunities. Aethir favors high-end setups for its global enterprise demand, while Nosana’s grid suits developers needing on-demand bursts. Evaluate your rig’s specs against each platform’s benchmarks; a mid-tier gaming PC might net $50-200 monthly in tokens, scaling with utilization.

Strategic Setup for DePIN GPU Earnings

Getting started requires more than a download. First, audit your hardware: ensure VRAM exceeds 8GB and cooling handles sustained loads. Platforms like POPAI offer node software that runs unobtrusively, throttling during gaming sessions to preserve performance.

Security is paramount. Vet platforms for audited smart contracts and non-invasive resource allocation. Nosana’s Solana foundation provides transparency via on-chain verification, reducing rug-pull risks. Compensation varies: hourly for DePINed, benchmark-based for Aethir. Factor in electricity costs; at current rates, breakeven hovers around 60-70% utilization for most U. S. households.

Diversification tempers volatility. Run nodes across two platforms to hedge token risks while capturing varied workloads. This decentralized AI GPU rental model not only generates crypto earn idle hardware but positions you as a stakeholder in AI’s decentralized future. As networks mature, early adopters stand to gain from governance tokens and airdrops, much like Oasis AI’s OAI distributions.

That said, strategic participation demands vigilance against pitfalls. Token volatility remains a wildcard; $NOS or $POPCOIN can swing 20-30% daily amid broader market whims. Electricity bills creep up with prolonged utilization, potentially eroding margins for those in high-cost regions. Hardware wear accelerates under constant AI loads, though modern gaming GPUs like RTX 4090s boast enterprise-grade endurance if temperatures stay below 80°C.

Balancing Risks with Proven Safeguards

Smart operators treat DePIN nodes as portfolio assets, not get-rich-quick schemes. Implement dynamic throttling via platform dashboards to pause during peak gaming hours, preserving both fun and profitability. Nosana’s incentive layers reward consistent uptime, but pair it with monitoring tools like HWInfo for real-time health checks. Diversify across idle GPU DePIN networks to smooth earnings; a split between Aethir’s enterprise gigs and POPAI’s peer-to-peer tasks captures diverse demand streams.

Regulatory shadows loom too. As DePIN scales, jurisdictions may scrutinize energy use or classify rewards as taxable income. Stay ahead by documenting contributions on-chain and consulting local tax pros. Platforms with transparent governance, like those audited by top firms, offer ballast against exploits. In my view, this friction weeds out casuals, rewarding those who approach DePIN GPU monetization 2025 with institutional rigor.

Comparison of Top DePIN Platforms for Gaming GPUs

| Platform | Supported Hardware (NVIDIA/AMD/Intel) | Avg Est. Monthly Yield ($50-300 for mid-high end) | Payout Token/Frequency | Min Requirements (8GB VRAM and ) |

|---|---|---|---|---|

| DePINed App | NVIDIA/AMD/Intel | $50-150 | Hourly earnings (USD equivalent) | 8GB VRAM and stable internet |

| Nosana | NVIDIA/AMD | $100-250 | NOS tokens / On job completion | 8GB VRAM and Solana wallet |

| Aethir | NVIDIA (high-end gaming GPUs) | $150-300 | ATH tokens / Periodic | 8GB VRAM and enterprise-grade setup |

| POPAI | NVIDIA/AMD/Intel | $80-220 | POPCOIN / Staking or trading | 8GB VRAM and POPAI Node software |

Yield estimates hinge on 70% utilization and current token prices, but real-world variance underscores the need for backtesting. Aethir edges out for sheer scale, channeling idle power into Fortune 500 AI pipelines, while DePINed’s hourly drips suit risk-averse starters.

Your Launch Playbook for Sustainable Earnings

This blueprint minimizes friction, turning setup into a 30-minute ritual. Early movers in 2025 report 15-25% annualized returns post-costs, outpacing many blue-chip staking yields. Yet, success favors the adaptive: tweak allocations as AI inference demand surges for lighter workloads over training behemoths.

Looking ahead, interoperability protocols will knit these silos into unified grids, amplifying liquidity for decentralized AI GPU rental. Imagine seamless swaps between Nosana jobs and Render renders, arbitraged by AI agents. For gamers, this means frictionless crypto earn idle hardware, with governance votes shaping network evolution.

Gaming PCs evolve from entertainment silos to hybrid powerhouses, anchoring the DePIN fabric that underpins scalable AI. By staking your silicon thoughtfully, you don’t just earn; you forge the infrastructure where tomorrow’s models train. In a world of centralized chokepoints, this decentralized edge is your strategic moat.