Imagine a world where your GPU rig isn’t just sitting idle waiting for token handouts, but actually getting paid based on real AI workloads crushing it in real-time. That’s the vibe io. net is bringing with their Incentive Dynamic Engine (IDE), a slick mechanism shaking up sustainable DePIN GPU supply for AI compute. As io. net’s IO token trades at $0.1654, up a modest and 1.27% in the last 24 hours with a high of $0.1699 and low of $0.1517, this isn’t just hype; it’s a trader’s dream for long-term stability in volatile DePIN markets.

io.net Technical Analysis Chart

Analysis by Market Analyst | Symbol: BINANCE:IOUSDT | Interval: 1D | Drawings: 6

Technical Analysis Summary

As a seasoned technical analyst with a balanced approach, I recommend annotating this io.net chart with a primary downtrend line connecting the swing high at approximately $0.60 in early January 2026 to the recent lows near $0.16, highlighting the steep bearish impulse. Add horizontal lines at key support ($0.1517) and resistance ($0.1699-$0.20) levels derived from recent highs/lows. Draw a rectangle around the late January to February 2026 consolidation zone between $0.155-$0.17 to mark potential accumulation. Place callouts on declining volume during the bottoming process and an upward arrow marker near the MACD histogram if showing bullish divergence. Vertical line at mid-January 2026 for the major breakdown event. Entry zone callout at $0.1654 with medium risk for longs on support bounce, targeting $0.20 profit and $0.15 stop loss.

Risk Assessment: medium

Analysis: Volatile DePIN sector with positive catalyst but technical damage from crash; consolidation offers setup but requires confirmation

Market Analyst’s Recommendation: Consider longs on support hold above $0.1517 targeting $0.20, position size 1-2% risk per my medium tolerance—wait for volume pickup

Key Support & Resistance Levels

📈 Support Levels:

-

$0.152 – Recent 24h low and chart bottom, strong volume shelf

strong -

$0.155 – Consolidation low, moderate hold

moderate

📉 Resistance Levels:

-

$0.17 – Recent 24h high, immediate overhead

weak -

$0.2 – Prior swing low now resistance, key breakout level

moderate

Trading Zones (medium risk tolerance)

🎯 Entry Zones:

-

$0.165 – Current price at support confluence with positive IDE news, potential bounce setup

medium risk

🚪 Exit Zones:

-

$0.2 – Next resistance target on breakout

💰 profit target -

$0.152 – Below recent low invalidates bounce

🛡️ stop loss

Technical Indicators Analysis

📊 Volume Analysis:

Pattern: decreasing volume on downtrend continuation, low in consolidation

High volume on initial drop, now drying up suggesting seller exhaustion—bullish sign

📈 MACD Analysis:

Signal: potential bullish divergence as price lows with contracting histogram

MACD line below signal but histogram narrowing, hinting reversal amid news catalyst

Applied TradingView Drawing Utilities

This chart analysis utilizes the following professional drawing tools:

Disclaimer: This technical analysis by Market Analyst is for educational purposes only and should not be considered as financial advice.

Trading involves risk, and you should always do your own research before making investment decisions.

Past performance does not guarantee future results. The analysis reflects the author’s personal methodology and risk tolerance (medium).

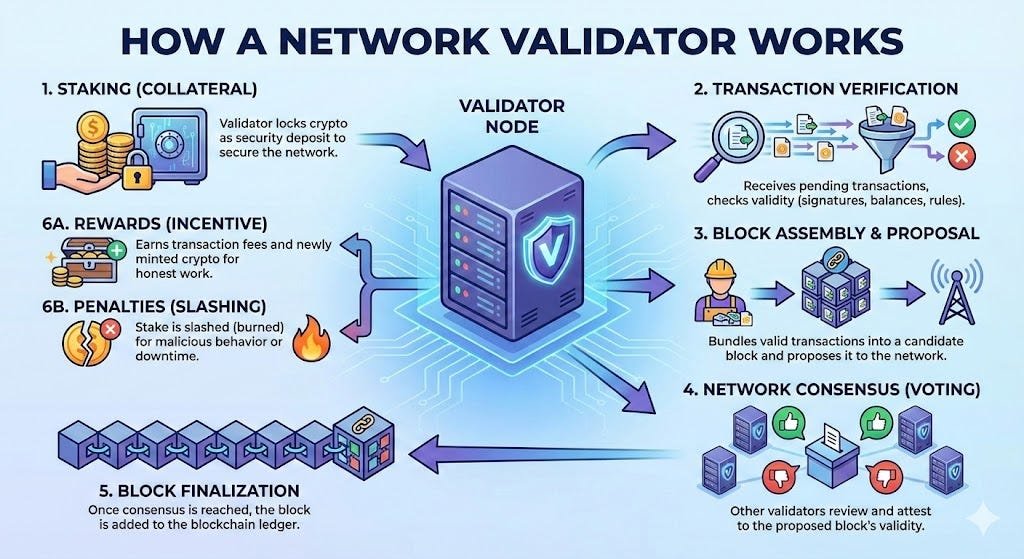

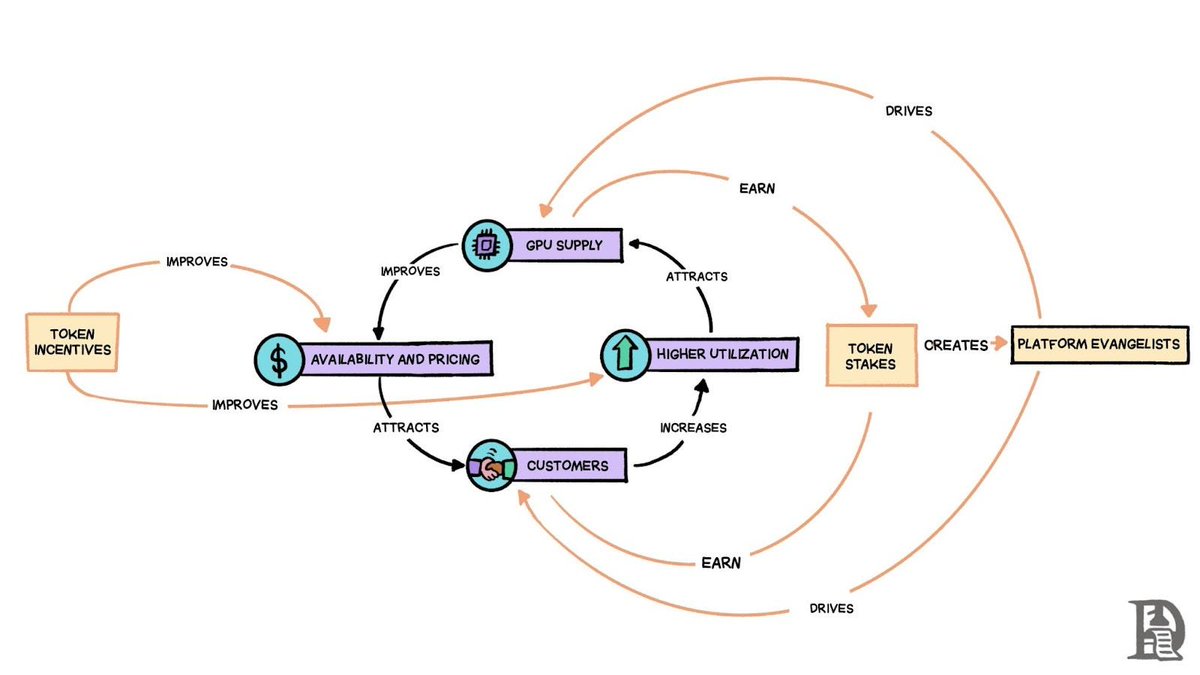

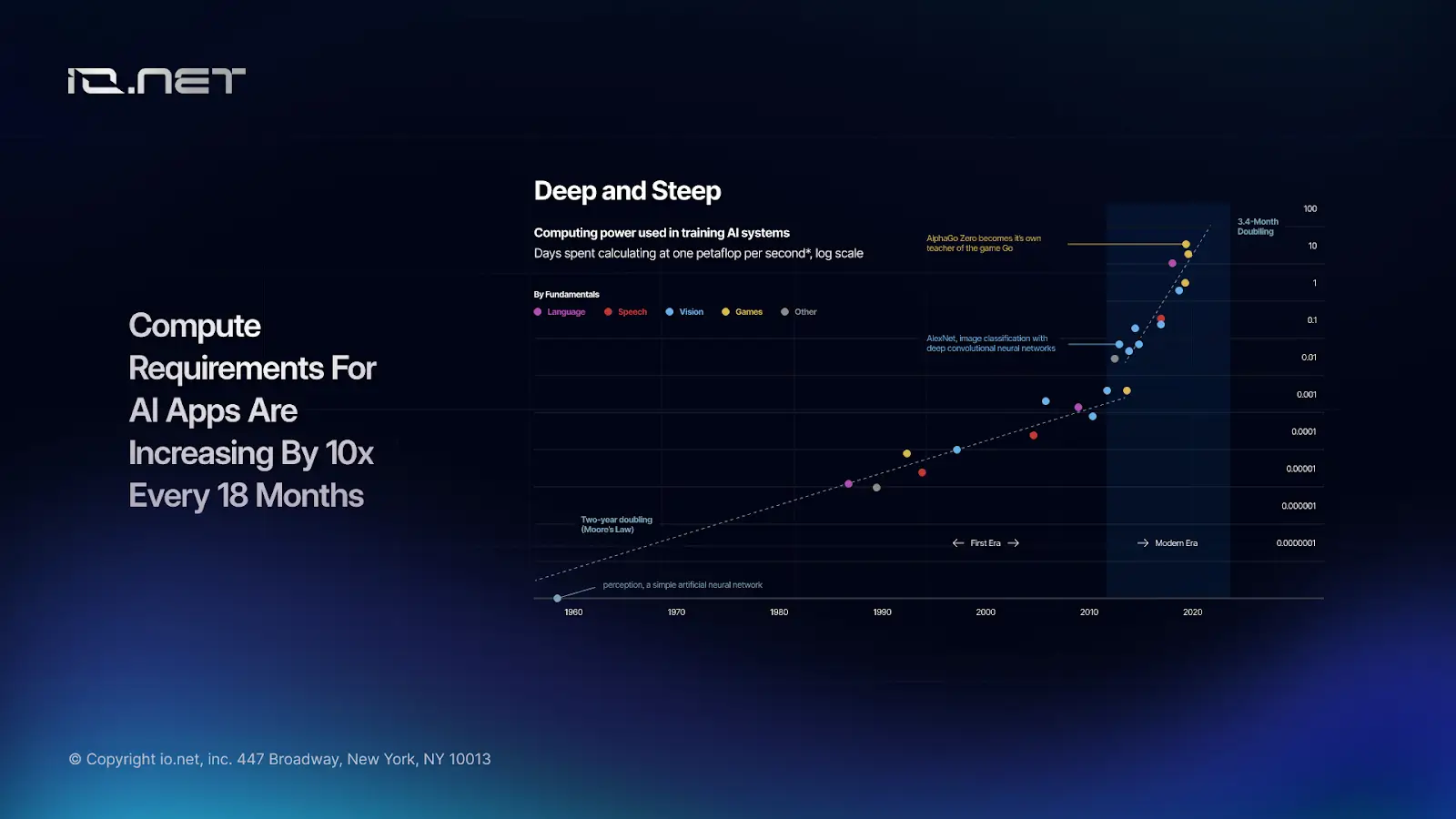

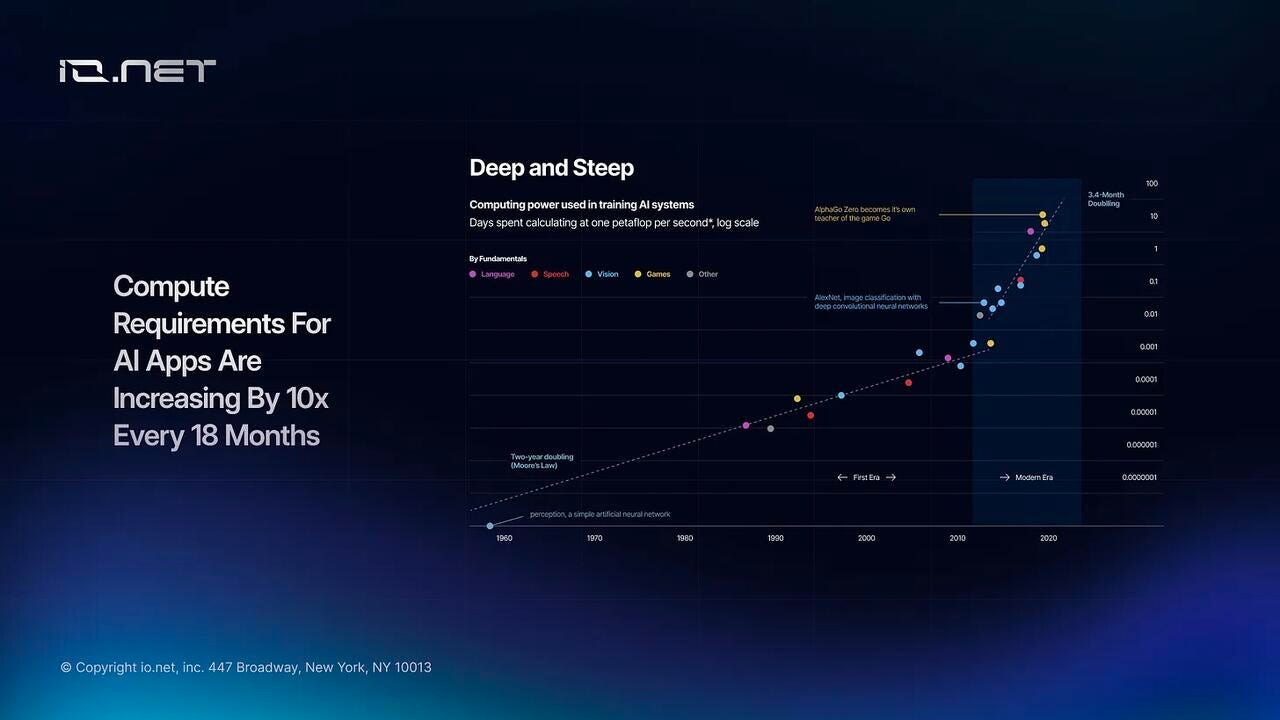

I’ve been trading DePIN tokens for years, and fixed emission models always felt like a ticking inflation bomb. io. net’s IDE flips the script by dynamically adjusting token emissions based on actual compute demand and GPU utilization. No more speculative floods diluting value; instead, rewards flow from genuine usage across their network spanning over 130 countries. It’s demand-driven tokenomics at its finest, with USD-pegged payouts for suppliers and real fees fueling token burns. This positions io. net as a legit challenger to centralized giants, making decentralized GPU supply reliable for enterprises hungry for AI power.

How the IDE Powers Sustainable AI Compute in DePIN

At its core, the IDE acts like a smart thermostat for the network’s economy. When AI workloads spike, emissions ramp up to incentivize more GPUs online. Slack demand? Emissions dial back, preventing oversupply and curbing inflation. This real-time adaptability is what sets io. net apart from other DePIN projects stuck in rigid schedules. Think of it as your trading bot that adjusts positions based on volume, not calendars.

Real fees → real burns. USD pegged supplier rewards.

io. net’s own words nail it. By linking $IO flows directly to compute usage, they’re building a flywheel: more jobs mean more fees, which burn tokens and stabilize rewards. A recent io. net study even shows consumer GPUs like the RTX 4090 slashing AI inference costs by up to 75% for LLMs, proving heterogeneous hardware can thrive sustainably. For traders like me, this screams reduced volatility and upside as adoption grows.

Stabilizing GPU Provider Income Across Global DePIN Networks

GPU suppliers have been the unsung heroes in DePIN, often facing wild swings in earnings from hype cycles. The IDE changes that by offering predictable, usage-tied income. Providers in over 130 countries get USD-pegged rewards, shielding them from crypto price dips. While IO sits at $0.1654 today, suppliers aren’t betting on token pumps; they’re cashing in on verifiable AI workloads.

This demand-response model fosters organic growth. Enterprises get consistent pricing, devs build without fearing supply droughts, and the network scales efficiently. Messari highlights how it overhauls tokenomics to tie emissions to demand, stabilizing suppliers while paving the way for enterprise adoption. It’s opinionated engineering: no more subsidizing idle rigs.

io.net (IO) Price Prediction 2027-2032

Projections based on Incentive Dynamic Engine (IDE) adoption, DePIN growth, and AI compute demand | Current Price (2026): $0.1654

| Year | Minimum Price ($) | Average Price ($) | Maximum Price ($) | Avg YoY Change (%) |

|---|---|---|---|---|

| 2027 | $0.12 | $0.55 | $1.80 | +233% |

| 2028 | $0.35 | $1.40 | $4.50 | +155% |

| 2029 | $0.60 | $2.20 | $7.00 | +57% |

| 2030 | $1.00 | $3.60 | $11.00 | +64% |

| 2031 | $1.40 | $5.80 | $16.00 | +61% |

| 2032 | $2.00 | $9.20 | $24.00 | +59% |

Price Prediction Summary

io.net (IO) is positioned for substantial growth with the IDE mechanism linking token emissions to real GPU usage in AI workloads, fostering sustainability and reducing inflation. Average prices are forecasted to rise progressively from $0.55 in 2027 to $9.20 by 2032 (55x from current), with maximums reflecting bullish AI/DePIN adoption and minimums accounting for bearish market cycles, regulatory hurdles, and competition.

Key Factors Affecting io.net Price

- IDE implementation tying emissions and burns to actual compute demand

- Explosive growth in AI inference workloads using decentralized GPUs

- Global expansion of GPU suppliers across 130+ countries

- Deflationary tokenomics from real fees enhancing scarcity

- Crypto market cycles, including bull runs post-Bitcoin halvings

- Regulatory developments favoring DePIN and AI infrastructure

- Technological improvements in heterogeneous consumer GPU compute

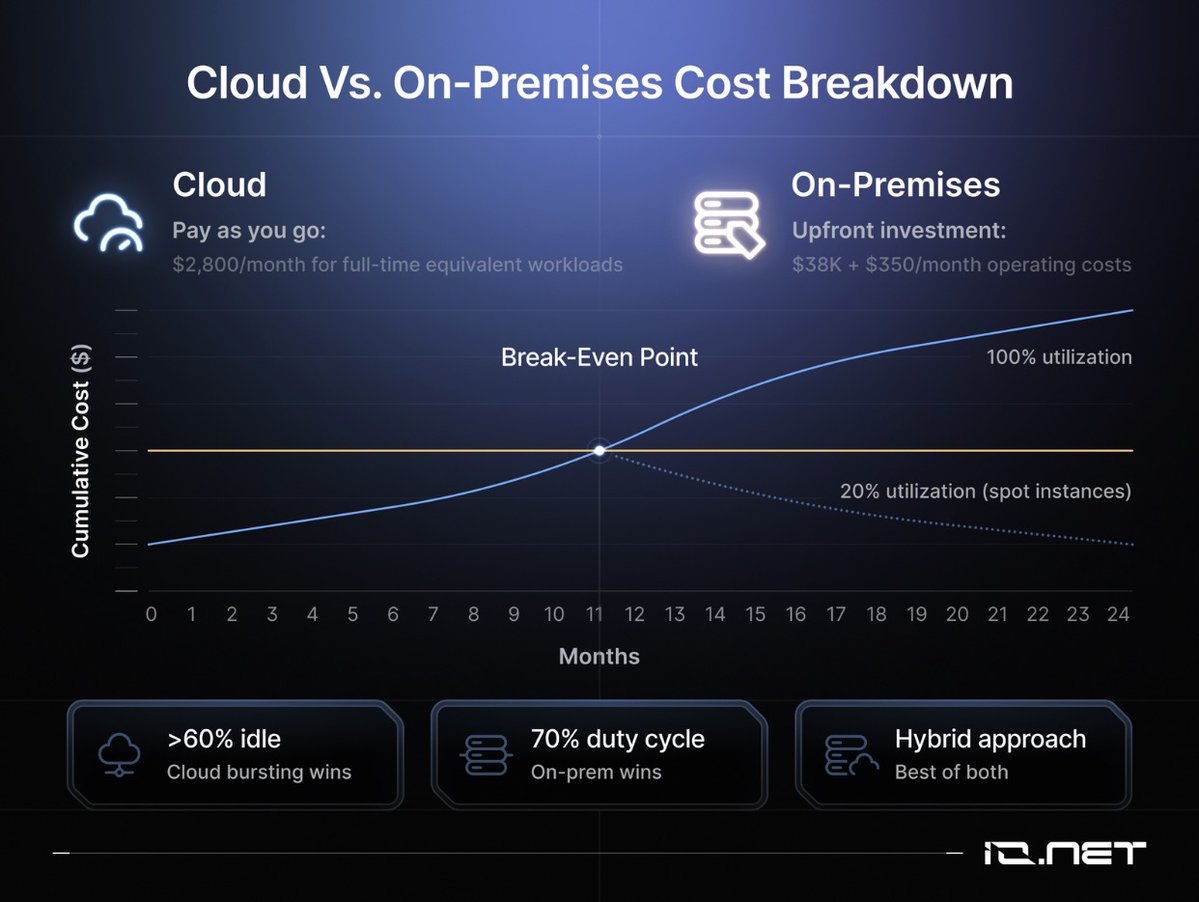

- Competition from centralized clouds (AWS, Google) and rivals (Render, Akash)

Disclaimer: Cryptocurrency price predictions are speculative and based on current market analysis.

Actual prices may vary significantly due to market volatility, regulatory changes, and other factors.

Always do your own research before making investment decisions.

Diving deeper, the IDE incorporates deflationary mechanics that reward actual utilization. As fees from AI jobs hit the protocol, a portion burns $IO, tightening supply just when demand heats up. This isn’t theoretical; it’s under community review now, with final tokenomics dropping end of March 2026. For DePIN GPU incentives, it’s a blueprint others will copy.

Check out how decentralized GPU networks are slashing AI compute costs, amplifying the IDE’s impact. io. net isn’t just supplying GPUs; they’re engineering a resilient ecosystem where sustainable AI compute DePIN meets real-world scalability.

Trading DePIN tokens like IO has taught me one thing: sustainability beats hype every time. With the IDE under community review and tokenomics finalized by late March 2026, we’re on the cusp of a network that self-regulates like a pro trader spotting overbought signals. GPU providers lock in steady income, users snag cheaper AI runs, and $IO at $0.1654 starts looking undervalued as utilization climbs.

DePIN GPU Incentives That Actually Stick

Let’s break down why DePIN GPU incentives via IDE are a game-changer. Traditional models dump tokens regardless of output, leading to rug-pull vibes when demand dries up. io. net’s engine? It verifies real AI workloads before payouts hit. Picture this: your RTX 4090 cluster fires up for LLM inference, racks up fees, and those fees trigger burns while pegging your reward to USD stability. No more praying for token pumps; it’s pay-for-performance pure and simple.

io.net IDE Key Features

-

Demand-Driven Emissions: Dynamically ties token supply to real GPU usage and compute demand—no more speculation!

-

USD-Pegged Rewards: Stable, dollar-pegged payouts for suppliers across 130+ countries, slashing volatility.

-

Real Fee Burns: Actual network fees get burned, fueling deflationary mechanics with every AI workload.

-

Global GPU Utilization: Unlocks compute power from GPUs in 130+ countries for seamless AI tasks.

-

Deflationary AI Tie-In: Token flows linked directly to real-world usage, building sustainable DePIN growth.

Suppliers in places like Indonesia or Brazil now compete on merit, not geography. This levels the field, drawing in heterogeneous hardware that centralized clouds shun. io. net’s study backs it: consumer GPUs crush costs by 75%, making AI workload verification DePIN not just buzz, but bankable efficiency.

For day traders, this means tighter spreads and less dump risk. I’ve seen DePIN tokens swing 50% on emission news alone. IDE caps that by syncing supply to jobs, potentially squeezing $IO higher as enterprises pile in. At $0.1654 with a 24-hour range from $0.1517 to $0.1699, it’s consolidating for a breakout if adoption metrics pop.

The Road Ahead for Decentralized GPU Supply

io. net isn’t stopping at mechanics; they’re forging paths to enterprise trust. By dodging fixed emissions, IDE sidesteps the speculation traps plaguing other DePINs. Hackernoon calls it a unique hook for big players wary of crypto volatility. Pair that with real-time adjustments, and you’ve got a network that scales like AWS but decentralized and dirt-cheap.

Community feedback is shaping the final design, ensuring buy-in from the ground up. Imagine GPUs worldwide humming on verifiable tasks, fees burning $IO steadily, rewards holding firm. That’s the flywheel accelerating decentralized GPU supply. Traders, watch utilization dashboards; they’ll signal the next leg up better than any chart.

Dive into how decentralized GPU networks power AI compute in DePIN for 2025 to see the bigger picture. io. net’s IDE isn’t tweaking dials; it’s rewriting the rules for sustainable, explosive growth in AI infrastructure. With IO steady at $0.1654, the setup feels primed for those who adapt fast.