In 2026, the insatiable demand for GPU compute in AI training and inference has turned decentralized networks into indispensable infrastructure. Centralized giants like AWS face chronic shortages and escalating costs, pushing innovators toward DePIN solutions. Render Network, Akash Network, and io. net stand out as the top contenders, each harnessing idle GPUs worldwide to deliver scalable, cost-effective power. With io. net’s IO token trading at $0.1015 after a slight 0.0213% dip over the last 24 hours, market dynamics underscore the sector’s maturation.

Render vs Akash vs io.net: 6-Month Price Performance of Top DePIN GPU Networks

Real-time comparison of Render (RNDR), Akash (AKT), and io.net (IO) tokens amid AI compute demand in 2026

| Asset | Current Price | 6 Months Ago | Price Change |

|---|---|---|---|

| Render (RNDR) | $1.32 | $1.45 | -9.0% |

| Akash Network (AKT) | $0.3161 | $0.2890 | +9.4% |

| io.net (IO) | $0.1016 | $0.0950 | +6.9% |

Analysis Summary

Over the past six months, Akash Network (AKT) has outperformed with a +9.4% gain, followed by io.net (IO) at +6.9%, while Render (RNDR) declined by -9.0%. This selective performance highlights strength in general-purpose DePIN networks amid moderate market growth.

Key Insights

- Akash Network (AKT) leads DePIN peers with +9.4% 6-month growth, surpassing Bitcoin’s +6.5%.

- io.net (IO) shows solid +6.9% appreciation, aligning with AI-focused altcoin trends.

- Render (RNDR) underperforms at -9.0%, contrasting its expansion into AI compute via Dispersed.com.

Data sourced exclusively from provided real-time CoinGecko prices as of 2026-02-10T16:13:21Z. 6-month changes calculated from prices on or around 2025-08-14; percentages formatted exactly as provided.

Data Sources:

- Main Asset: https://www.coingecko.com/en/coins/render

- Akash Network: https://www.coingecko.com/en/coins/akash-network

- io.net: https://www.coingecko.com/en/coins/io-net

- Bittensor: https://www.coingecko.com/en/coins/bittensor

- Golem: https://www.coingecko.com/en/coins/golem

- Artificial Superintelligence Alliance: https://www.coingecko.com/en/coins/artificial-superintelligence-alliance

- Bitcoin: https://www.coingecko.com/en/coins/bitcoin

- Ethereum: https://www.coingecko.com/en/coins/ethereum

Disclaimer: Cryptocurrency prices are highly volatile and subject to market fluctuations. The data presented is for informational purposes only and should not be considered as investment advice. Always do your own research before making investment decisions.

These platforms address key pain points: Render excels in spiky workloads like 3D rendering and AI inference, Akash provides general-purpose flexibility with 60-70% savings over AWS, and io. net specializes in enterprise-grade AI/ML orchestration. Their growth trajectories reveal a maturing ecosystem where blockchain incentivizes underutilized hardware, slashing total cost of ownership while enhancing fault tolerance.

Render Network: From Hollywood Renders to AI Inference Dominance

Render Network pioneered peer-to-peer GPU rendering, but by 2026, it has masterfully pivoted to AI compute. Launching Dispersed. com in late 2025 aggregated over 14,000 active GPUs, processing millions of VFX and AI jobs. AI inference now claims 40% of capacity, a boon for developers facing traditional cloud queues. This Hollywood-honed credibility translates to reliable performance for bursty demands, where marketplace dynamics lower unit costs precisely when spikes hit.

Render’s edge lies in its niche positioning. Unlike broader clouds, it optimizes for graphics-intensive tasks intertwined with AI, such as generative models for visual effects. Q3 2025 saw 75% payout growth, signaling robust node operator incentives via RNDR token economics. For AI builders prioritizing quality over sheer volume, Render offers a battle-tested network with proven scalability.

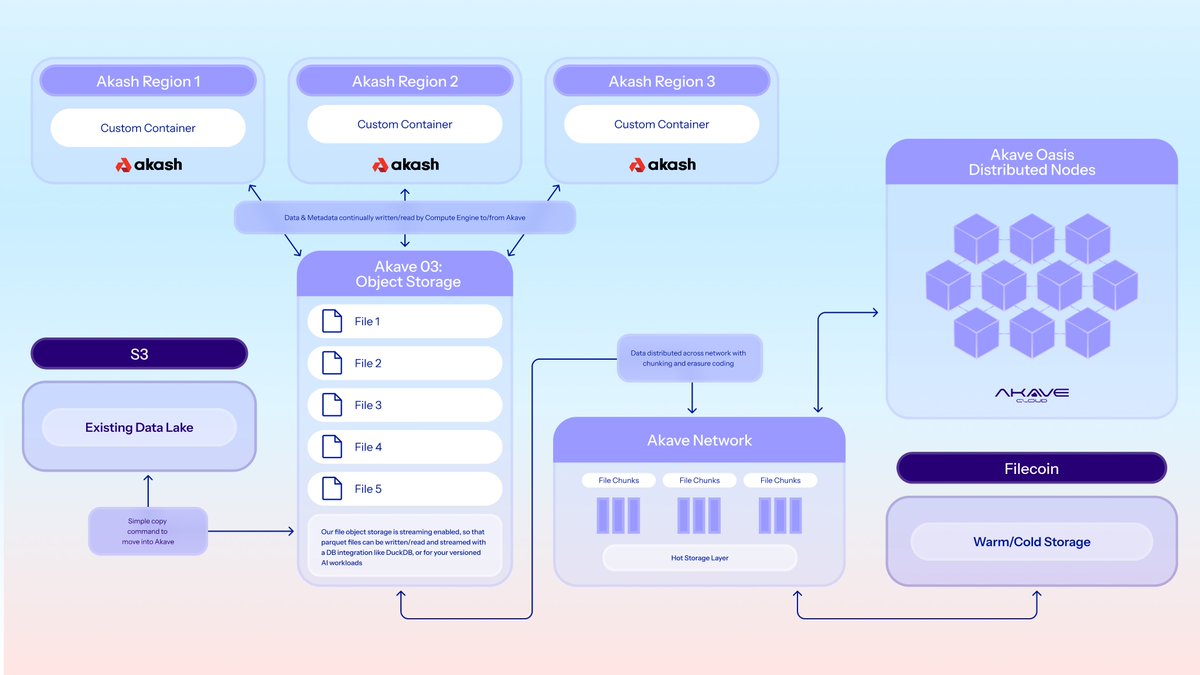

Akash Network: Flexibility Meets High-Utilization Compute

Akash Network reimagines cloud marketplaces as decentralized alternatives, with AkashML unlocking GPU leasing since 2023. Boasting 80% and utilization into 2026 and 428% YoY growth, it integrates cutting-edge NVIDIA Blackwell B200/B300 GPUs for on-chain training. Though active GPUs number around 365, its general-purpose design covers diverse workloads, from AI to web hosting, at 60-70% less than centralized providers.

The platform’s strength is adaptability. Users deploy custom Kubernetes bids, matching supply to needs without vendor lock-in. This resonates in a 2026 landscape where AI stacks evolve rapidly; Akash’s agnostic approach suits experimentation across models. Cost savings stem from global idle capacity, risk-mitigated via slashing mechanisms, making it ideal for enterprises scaling predictably yet economically.

Render vs Akash vs io.net: DePIN GPU Networks Price Predictions 2027-2032

Min/Avg/Max price predictions (USD) for RNDR, AKT, and IO amid AI compute boom, market cycles, and DePIN adoption

| Year | Asset | Min Price (USD) | Avg Price (USD) | Max Price (USD) |

|---|---|---|---|---|

| 2027 | RNDR | $2.00 | $4.20 | $8.50 |

| 2027 | AKT | $1.00 | $2.10 | $4.30 |

| 2027 | IO | $0.20 | $0.55 | $1.20 |

| 2028 | RNDR | $3.20 | $6.50 | $13.00 |

| 2028 | AKT | $1.60 | $3.30 | $6.80 |

| 2028 | IO | $0.35 | $0.90 | $2.20 |

| 2029 | RNDR | $5.00 | $10.50 | $22.00 |

| 2029 | AKT | $2.50 | $5.50 | $11.50 |

| 2029 | IO | $0.70 | $1.80 | $4.50 |

| 2030 | RNDR | $7.50 | $16.00 | $34.00 |

| 2030 | AKT | $4.00 | $8.50 | $18.00 |

| 2030 | IO | $1.30 | $3.50 | $9.00 |

| 2031 | RNDR | $11.00 | $24.00 | $52.00 |

| 2031 | AKT | $6.00 | $13.00 | $28.00 |

| 2031 | IO | $2.20 | $6.00 | $16.00 |

| 2032 | RNDR | $16.00 | $36.00 | $78.00 |

| 2032 | AKT | $9.00 | $20.00 | $44.00 |

| 2032 | IO | $3.50 | $10.00 | $28.00 |

Price Prediction Summary

DePIN GPU networks like Render (RNDR), Akash (AKT), and io.net (IO) are forecasted to see substantial growth from 2027-2032, fueled by AI compute demand outstripping centralized supply. RNDR leverages Hollywood VFX expansion into AI (14k+ GPUs, 40% AI utilization); AKT offers flexible cloud with 80%+ utilization and Blackwell GPUs; IO scales massively (214k+ GPUs) for ML workloads. Min prices reflect bear markets/regulatory hurdles; avg base adoption growth; max bullish AI/DePIN supercycle. Overall 8-20x potential from 2026 levels, with IO offering highest upside due to GPU volume, tempered by competition.

Key Factors Affecting Render Network Price

- Surging AI training/inference demand, positioning DePIN as critical infrastructure (60-70% cost savings vs AWS)

- GPU supply expansion and high utilization (IO: 214k GPUs; Render: 14k+; Akash: 365+ with 428% YoY growth)

- Crypto market cycles: recovery post-2026 correction, bull runs in 2029/2032

- Regulatory clarity on decentralized compute and tokenomics

- Tech advancements: distributed training, NVIDIA integrations, fault-tolerant orchestration

- Competition dynamics: Render’s niche cred vs Akash flexibility vs IO scale

- Enterprise/Hollywood adoption and partnerships driving network effects

Disclaimer: Cryptocurrency price predictions are speculative and based on current market analysis.

Actual prices may vary significantly due to market volatility, regulatory changes, and other factors.

Always do your own research before making investment decisions.

io. net: Purpose-Built for AI/ML Scale and Speed

io. net zeroes in on AI workloads, aggregating 214,387 online GPUs from data centers and miners as of recent metrics. Supporting distributed training, inference, and reinforcement learning, it features native orchestration for fault-tolerant clusters. This specialization yields rapid deployment, crucial as AI models balloon in complexity.

With a total supply exceeding 371,000 GPUs, io. net targets enterprise pain points like TCO and performance parity with centralized setups. Its Solana foundation ensures low-latency coordination, positioning it as the go-to for high-throughput ML pipelines. As IO holds steady at $0.1015, investor confidence reflects io. net’s traction in a GPU-starved market.

io. net’s architecture shines in distributed setups, where clusters span geographies without sacrificing coherence. For teams training large language models or fine-tuning vision transformers, its built-in fault tolerance minimizes downtime, a frequent Achilles’ heel in centralized environments. This focus on decentralized AI GPU marketplace dynamics positions io. net as the scalpel for precision AI workloads, contrasting Render’s hammer for creative bursts and Akash’s Swiss Army knife versatility.

Render vs Akash vs io.net: Comparative Overview (2026 DePIN GPU Networks)

| Feature | Render Network | Akash Network | io.net |

|---|---|---|---|

| Primary Focus | 3D Rendering + AI Inference | Versatile Kubernetes Cloud | Massive Parallel AI/ML Training |

| Active GPUs | 14,000+ | 365 | 214,387 |

| Utilization Rate | 40%+ (AI tasks) | 80%+ | Data not specified |

| Key Advantages | 🎥 Hollywood credibility & spiky AI demand marketplace (vs. traditional queues) | 🔄 Flexibility & 60-70% cost savings vs AWS (high util, general-purpose) | 📈 Unmatched scale & rapid deployment for enterprise AI (specialized workloads) |

Cost structures further differentiate them. Akash leads with 60-70% savings over AWS, leveraging marketplace bidding for predictable economics. Render matches this for spiky Render Network vs Akash scenarios, where idle capacity floods in during peaks. io. net, though pricing varies by cluster, undercuts hyperscalers via miner-sourced GPUs, often 50% cheaper for sustained ML runs. In benchmarks, io. net edges inference latency by 20-30% over Akash, per recent developer reports, while Render excels in VRAM-intensive generative tasks.

Security and decentralization add nuance. All employ slashing for misbehavior, but io. net’s Solana backbone offers sub-second finality, critical for real-time RLHF. Akash’s Cosmos SDK ensures interoperability, appealing to multi-chain AI stacks. Render’s Ethereum Layer 2 scaling mitigates gas volatility, fostering node loyalty amid RNDR incentives.

Which DePIN GPU network will dominate AI compute in 2026?

Render Network (14K+ GPUs, creative AI & rendering), Akash Network (80%+ utilization, flexible cloud), io.net (214K GPUs, ML scale), or Other?

Real-world adoption cements their roles. Render powers VFX pipelines at major studios, extending to Stable Diffusion variants. Akash hosts experimental Llama deployments, its flexibility shining in hybrid CPU-GPU bids. io. net clusters underpin DeFi agents and autonomous trading bots, where GPU throughput directly correlates to alpha generation.

Investment Lens: Navigating Tokens in a GPU-Hungry Market

From a portfolio perspective, tokenomics drive long-term viability. io. net’s IO at $0.1015 reflects measured growth, with supply unlocks balancing demand from enterprise onboarding. AKT benefits from Akash’s utility surge, tying value to bid volume. RNDR captures Render’s premium for quality compute, buoyed by AI inference uptick.

Risk mitigation favors diversification: allocate to io. net for volume plays, Akash for steady utilization yields, Render for narrative tailwinds in entertainment-AI convergence. Macro headwinds like Blackwell supply ramps could pressure DePIN premiums, yet chronic shortages sustain 40-60% discounts versus centralized clouds. Precision here means matching exposure to workload forecasts; patience rewards those betting on DePIN vs centralized clouds 2026 disruption.

These networks aren’t competitors in a zero-sum game but complementary layers in the AI stack. Render for the artist’s burst, Akash for the engineer’s steady grind, io. net for the scientist’s symphony of scale. As GPU scarcity persists, their blockchain incentives unlock trillions in idle capacity, reshaping compute economics for good.