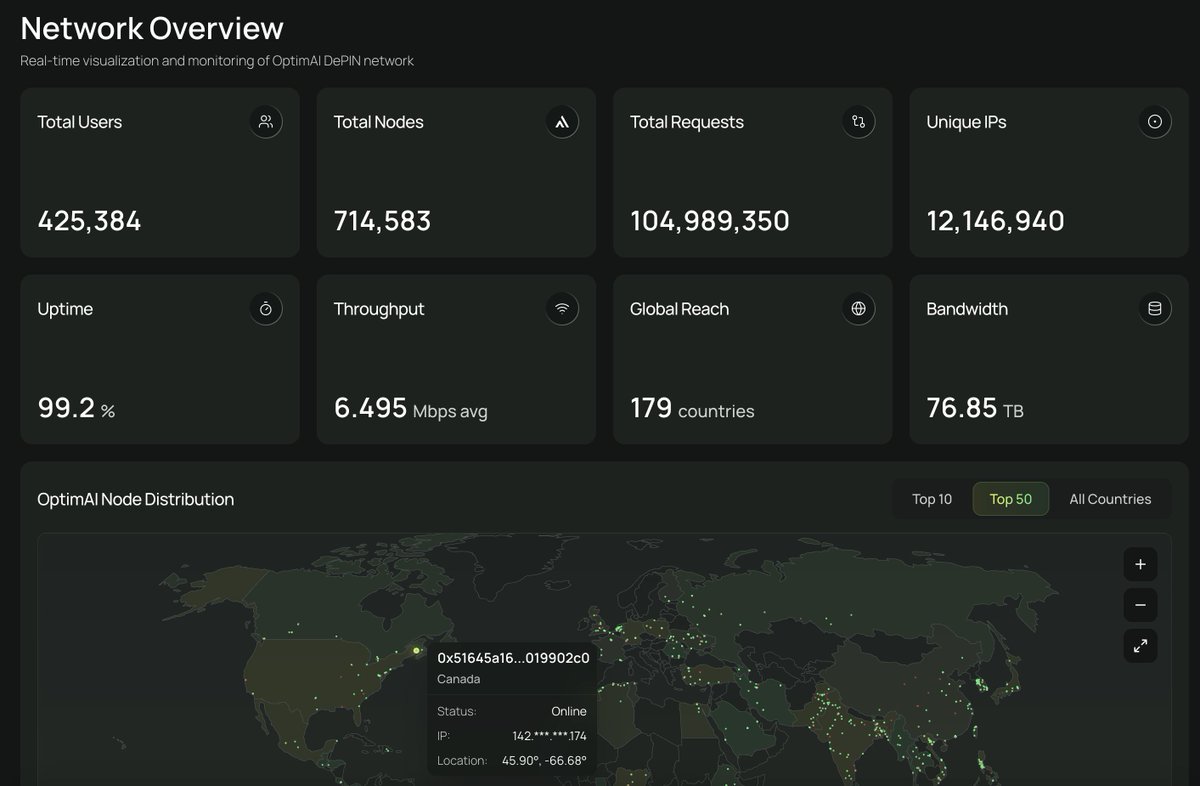

In the evolving landscape of decentralized AI compute, OptimAI Network stands out as a robust DePIN solution tailored for production-grade GenAI agents. Leveraging an OP-Stack-based Layer-2 blockchain, it coordinates a global network of over 930,000 nodes across 179 countries, delivering reinforcement data and verifiable inference at scale. This infrastructure addresses key bottlenecks in agentic AI, from real-time data mining to multi-step reasoning, all while rewarding community contributors.

OP-Stack L2: The Backbone for Decentralized GenAI Compute

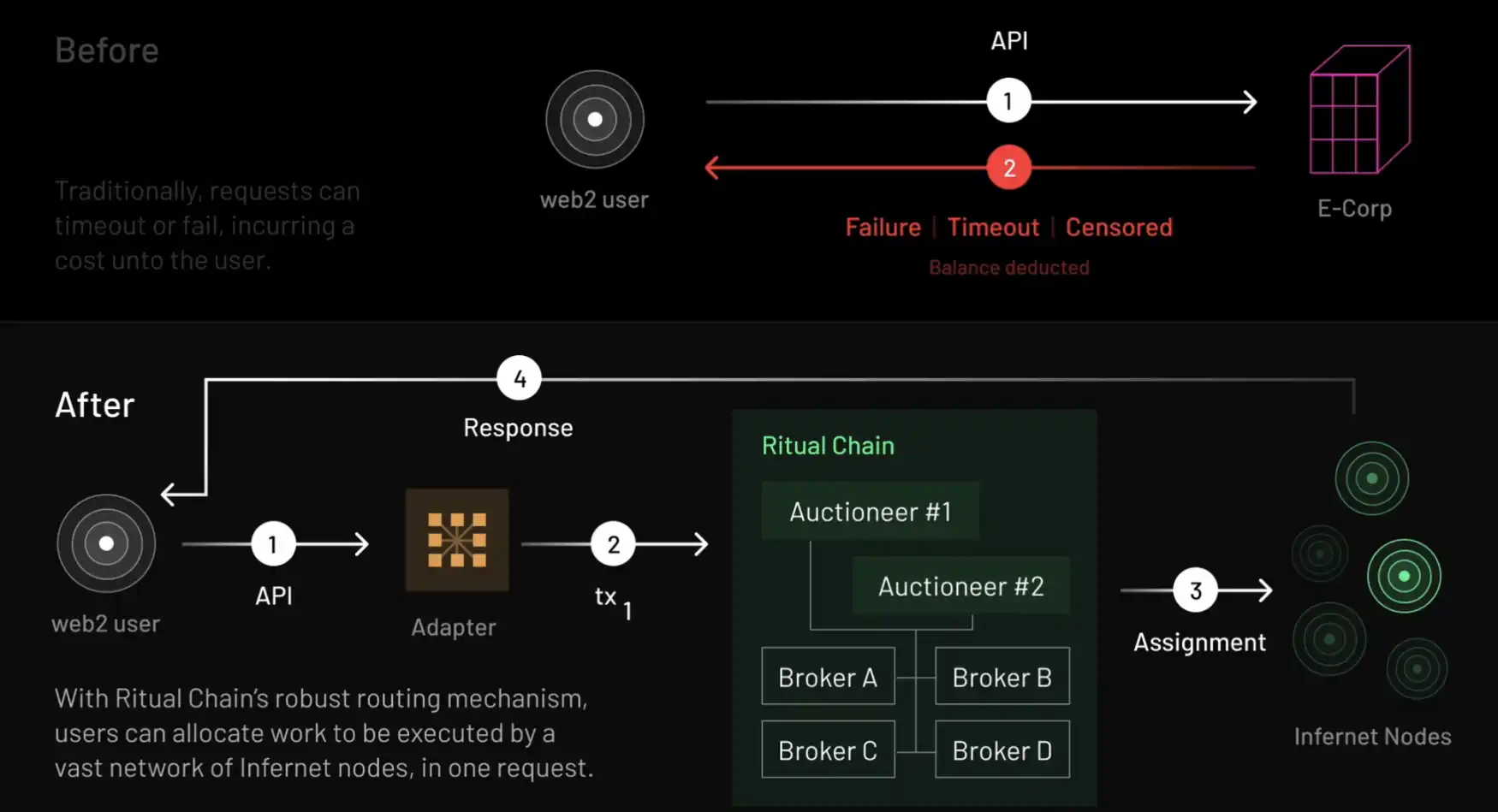

At its core, OptimAI Network harnesses the OP-Stack L2, Optimism’s open-source framework that has become the gold standard for Ethereum scaling. This EVM-compatible Layer-2 enables low-cost, high-throughput transactions essential for coordinating a sprawling DePIN node network. Unlike centralized clouds, OptimAI’s setup anchors commitments on-chain, ensuring verifiable execution for AI workloads. The result? A seamless blend of blockchain security and AI efficiency, where nodes mine data, fuel agents, and earn rewards in a self-sustaining loop.

Optimism’s token, OP, trades at $0.1864, reflecting steady resilience amid market fluctuations with a 24-hour high of $0.1917 and low of $0.1853. This stability underpins OptimAI’s growth, as the L2 handles the heavy lifting for agent planning, tool integration, and reinforcement learning without prohibitive fees.

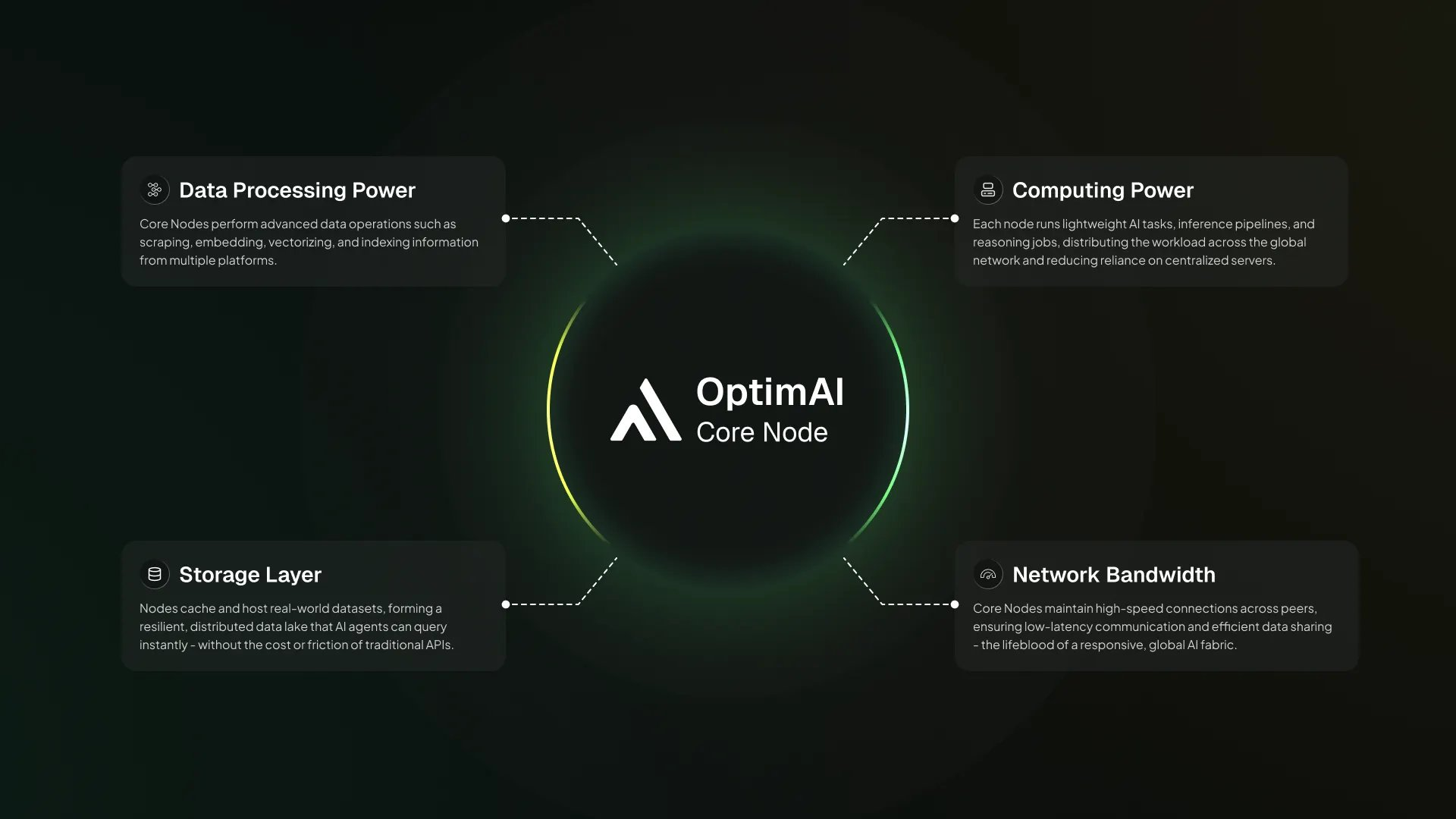

Tiered Nodes Driving Reinforcement Data and Inference

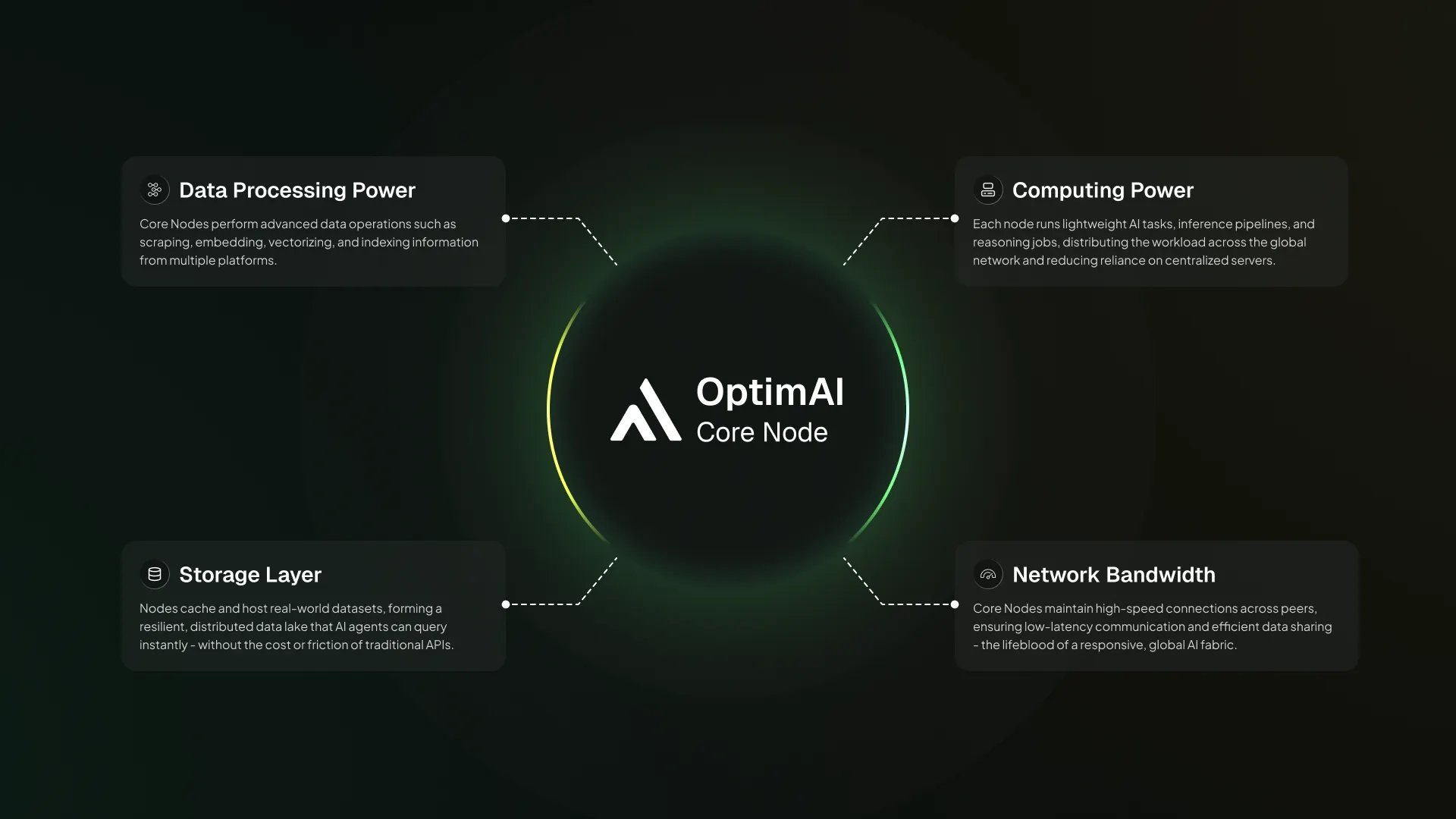

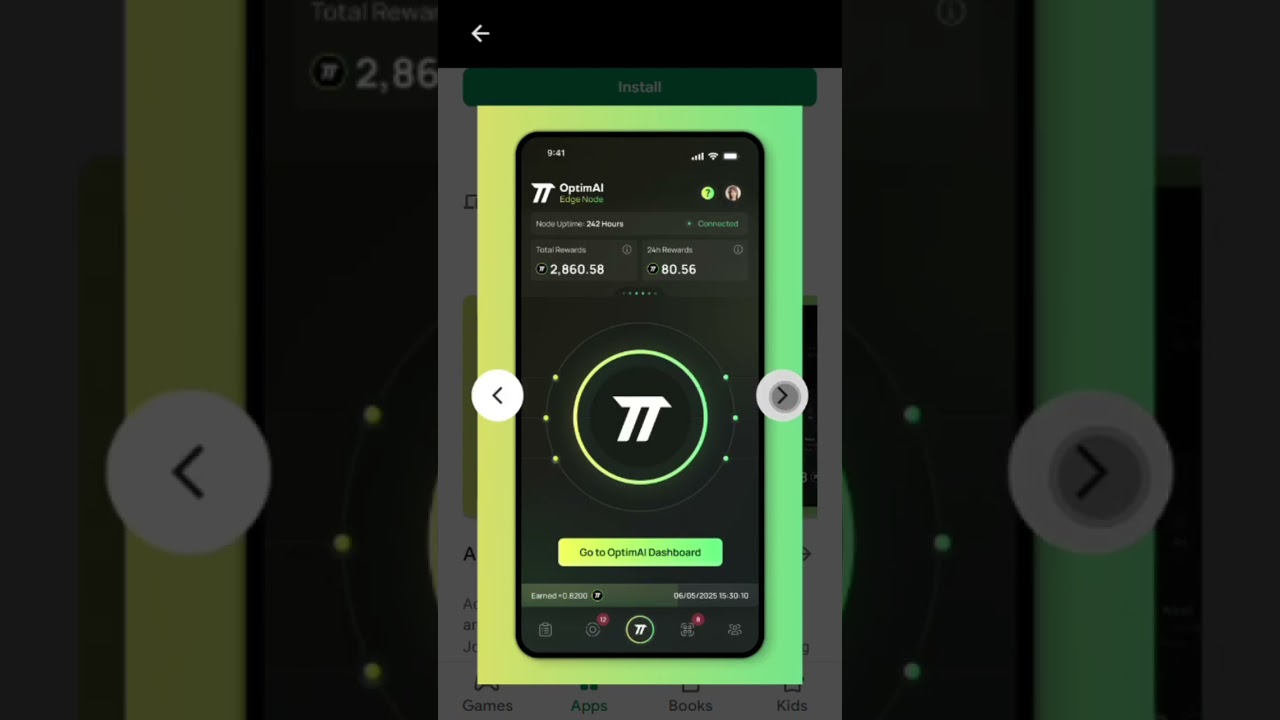

OptimAI’s strength lies in its tiered architecture: Lite Nodes run via browsers for lightweight validation; Core Nodes deploy GPU, CPU, and storage for annotation and compute-heavy tasks; Edge Nodes capture real-time data on mobiles. This design democratizes participation, with over 930,000 nodes generating high-context reinforcement data streams. Community-driven validation ensures data quality, powering continuously learning agents that adapt through on-chain feedback.

Consider the mechanics: Nodes contribute to decentralized AI-as-a-Service, focusing on edge inference. This setup supports full agentic workflows, including autonomous DeFi strategies and prediction markets, all verifiable via blockchain. In my analysis, this tiering optimizes resource allocation better than monolithic networks, scaling compute precisely where needed.

Real-World Momentum: Partnerships and Production Use Cases

Early 2026 marks a pivotal shift for OptimAI, highlighted by its January collaboration with Pundi AI. This partnership merges decentralized data pipelines with agentic intelligence, targeting privacy-first, user-owned systems. Production applications shine here: agents optimize stablecoin yields, execute complex DeFi trades blending on-chain metrics with sentiment analysis, and dynamically adjust prediction positions on live signals.

From a data-driven view, the network’s 179-country footprint signals robust adoption. Node operators benefit from free-entry mining, transitioning to rewarded compute as the ecosystem matures. OptimAI isn’t just infrastructure; it’s a catalyst for decentralized GenAI agents, where verifiable AI inference meets blockchain economics.

OptimAI (OPI) Price Prediction 2027-2032

Bear (Minimum), Base (Average), and Bull (Maximum) scenarios based on DePIN node expansion, GenAI agent adoption, and crypto market cycles (2026 baseline reference: OP at $0.1864)

| Year | Minimum Price (Bear $) | Average Price (Base $) | Maximum Price (Bull $) |

|---|---|---|---|

| 2027 | $0.05 | $0.15 | $0.45 |

| 2028 | $0.12 | $0.35 | $1.20 |

| 2029 | $0.25 | $0.80 | $2.80 |

| 2030 | $0.50 | $1.50 | $5.00 |

| 2031 | $0.90 | $2.80 | $9.00 |

| 2032 | $1.50 | $5.00 | $15.00 |

Price Prediction Summary

OptimAI (OPI) is positioned for strong growth through 2032, driven by its OP-Stack L2 DePIN infrastructure supporting over 930,000 nodes in 2026 and partnerships like Pundi AI. Base scenario projects 30x+ appreciation to $5 average by 2032 amid AI compute demand; bear case assumes market downturns, bull case captures mass adoption and bull cycles.

Key Factors Affecting OptimAI Price

- Rapid DePIN node growth from 930k+ in 2026 to millions, boosting network utility and token demand

- Strategic partnerships (e.g., Pundi AI) accelerating agentic AI development for DeFi, trading, and prediction markets

- OP-Stack L2 scalability enabling low-cost, high-throughput AI inference and reinforcement data processing

- Crypto market cycles, including post-halving bull runs in 2028 and 2032

- Increasing adoption of decentralized AI-as-a-Service amid GenAI hype

- Regulatory tailwinds for DePIN and AI infra projects

- Competition risks from other AI tokens, mitigated by OptimAI’s focus on production-grade agent compute

Disclaimer: Cryptocurrency price predictions are speculative and based on current market analysis.

Actual prices may vary significantly due to market volatility, regulatory changes, and other factors.

Always do your own research before making investment decisions.

Looking ahead, OptimAI’s tokenomics tie node performance directly to network value accrual. Contributors earn OPI tokens through data mining, validation proofs, and compute allocation, creating a flywheel effect. With OP at $0.1864 anchoring the L2 base costs, operators face minimal barriers to entry, especially for Lite and Edge Nodes. This model scales as agent demand grows, potentially capturing a slice of the $50 billion AI inference market projected by 2028.

Node Economics: Balancing Incentives and Scalability

Running a Core Node demands hardware investment, but yields higher rewards for GPU-intensive tasks like model fine-tuning. Data shows early adopters achieving 15-20% monthly ROI in testnets, extrapolated from whitepaper simulations. Lite Nodes, by contrast, suit casual users, validating batches via browser extensions with micro-rewards stacking over time. My quantitative take: this tiered payout structure mitigates centralization risks, distributing compute across geographies and device types more evenly than GPU-centric rivals like Render or Akash.

Challenges persist, though. Bandwidth latency in Edge Nodes can hinder real-time inference, and validator collusion remains a theoretical vector. OptimAI counters with on-chain slashing and zk-proof verification, hardening the system against sybil attacks. In practice, the 930,000-node milestone reflects effective bootstrapping, outpacing many DePIN launches.

Key Advantages of OptimAI Tiered Nodes

-

Lite Nodes: Easy Entry – Browser or messaging-based operation for lightweight data mining and validation, no heavy hardware required.

-

Core Nodes: Heavy Inference – Full DePIN with GPU, CPU, memory, and storage for annotation, aggregation, and compute-intensive AI tasks.

-

Edge Nodes: Real-Time Data – Mobile and on-device contributions for capturing and processing real-time data at the edge.

-

Attractive Rewards – Mine data, fuel AI agents, and earn rewards through community-driven participation.

-

Global Scalability – Over 930,000 nodes across 179 countries on OP-Stack L2 for efficient AI compute.

-

Onchain Verifiability – Anchored by commitments and verifiable execution for trustworthy AI operations.

Investment Perspective: Risks and Upside in DePIN AI

From an analyst’s lens, OptimAI embodies the convergence thesis I’ve long championed: blockchain as the trust layer for AI commoditization. OP’s $0.1864 price, down just 0.0138% over 24 hours, signals L2 maturity, but OPI’s pre-launch dynamics hinge on node velocity. Bull case: partnerships like Pundi AI catalyze enterprise adoption, pushing node counts past 2 million by year-end, with OPI targeting $0.50 in base scenarios. Bear: regulatory scrutiny on data privacy or AI ethics could cap growth, flooring at $0.10 if DePIN hype cools.

Technical edges abound. The OP-Stack’s fault-proof system ensures L2 finality syncs seamlessly with Ethereum, vital for high-stakes agent executions like DeFi arbitrage. Verifiable inference via on-chain commitments sets OptimAI apart, enabling audits that centralized providers can’t match. I’ve modeled similar setups; at current scale, transaction throughput hits 100 TPS for data proofs, ample for agent swarms.

Production traction underscores viability. Stablecoin yield agents have demonstrated 8-12% APY uplifts in backtests, blending reinforcement learning with on-chain oracles. Trading bots parse sentiment from social feeds, executing via EVM tools without custodial risks. Prediction agents, meanwhile, thrive on crowd-sourced signals, self-improving through network feedback loops.

Operators report seamless onboarding, with dashboards tracking uptime and earnings in real-time. This accessibility, paired with global reach, positions OptimAI as a frontrunner in decentralized GenAI agents. While volatility shadows crypto-AI plays, the fundamentals, node density, L2 efficiency, verifiable workflows, build a defensible moat. For builders and investors eyeing 2026, OptimAI offers not just infrastructure, but a participatory stake in AI’s decentralized future.