In the high-stakes arena of DePIN AI compute networks, io. net and Akash Network stand out as pivotal players vying for dominance in decentralized GPU AI inference. As enterprises grapple with skyrocketing demand for real-time AI processing, these platforms promise scalable, cost-effective alternatives to monolithic cloud giants. io. net’s IO token trades at $0.1125, reflecting a modest 24-hour gain of and 0.0342%, underscoring steady interest amid broader market volatility. Akash, meanwhile, powers a robust marketplace with 70% GPU utilization across 736 units, generating over $4.3 million in annual revenue. This io. net vs Akash showdown reveals divergent strategies: one laser-focused on GPU aggregation, the other a versatile compute bazaar.

io.net vs Akash Network: Decentralized GPU Platforms 6-Month Price Comparison

Real-time cryptocurrency prices and 6-month performance for io.net (IO), Akash Network (AKT), and related DePIN/benchmark assets (as of 2026-02-18)

| Asset | Current Price | 6 Months Ago | Price Change |

|---|---|---|---|

| io.net (IO) | $0.1121 | $0.1269 | -11.6% |

| Akash Network (AKT) | $0.3346 | $0.6960 | -51.9% |

| Render Network (RNDR) | $1.44 | $1.77 | -18.6% |

| Bittensor (TAO) | $189.59 | $207.80 | -8.8% |

| Golem (GLM) | $0.1795 | $0.1830 | -1.9% |

| iExec RLC (RLC) | $0.4403 | $0.4500 | -2.1% |

| Bitcoin (BTC) | $67,088.00 | $65,000.00 | +3.2% |

| Ethereum (ETH) | $1,973.48 | $1,800.00 | +9.6% |

Analysis Summary

Over the past six months, decentralized computing assets like io.net (-11.6%) and Akash Network (-51.9%) have declined, with AKT showing the sharpest drop among peers. In contrast, Bitcoin (+3.2%) and Ethereum (+9.6%) posted modest gains, highlighting a shift in investor sentiment toward established cryptocurrencies.

Key Insights

- Akash Network (AKT) plummeted 51.9%, the worst performer in the group.

- io.net (IO) declined 11.6%, better than most DePIN tokens but trailing BTC/ETH.

- DePIN sector broadly down: RNDR -18.6%, TAO -8.8%, GLM -1.9%, RLC -2.1%.

- Bitcoin and Ethereum bucked the trend with gains of +3.2% and +9.6%.

Prices and 6-month changes sourced exclusively from provided real-time CoinGecko data (e.g., io.net as of 2026-02-18T01:15:07Z; others aligned). 6-month reference ~2025-08-22. No estimations used.

Data Sources:

- Main Asset: https://www.coingecko.com/en/coins/io-net/historical_data

- Akash Network: https://www.coingecko.com/en/coins/akash-network/historical_data

- Bitcoin: https://www.coingecko.com/en/coins/bitcoin/historical_data

- Ethereum: https://www.coingecko.com/en/coins/ethereum/historical_data

- Render Network: https://www.coingecko.com/en/coins/render-network/historical_data

- Bittensor: https://www.coingecko.com/en/coins/bittensor/historical_data

- Golem: https://www.coingecko.com/en/coins/golem/historical_data

- iExec RLC: https://www.coingecko.com/en/coins/iexec-rlc/historical_data

Disclaimer: Cryptocurrency prices are highly volatile and subject to market fluctuations. The data presented is for informational purposes only and should not be considered as investment advice. Always do your own research before making investment decisions.

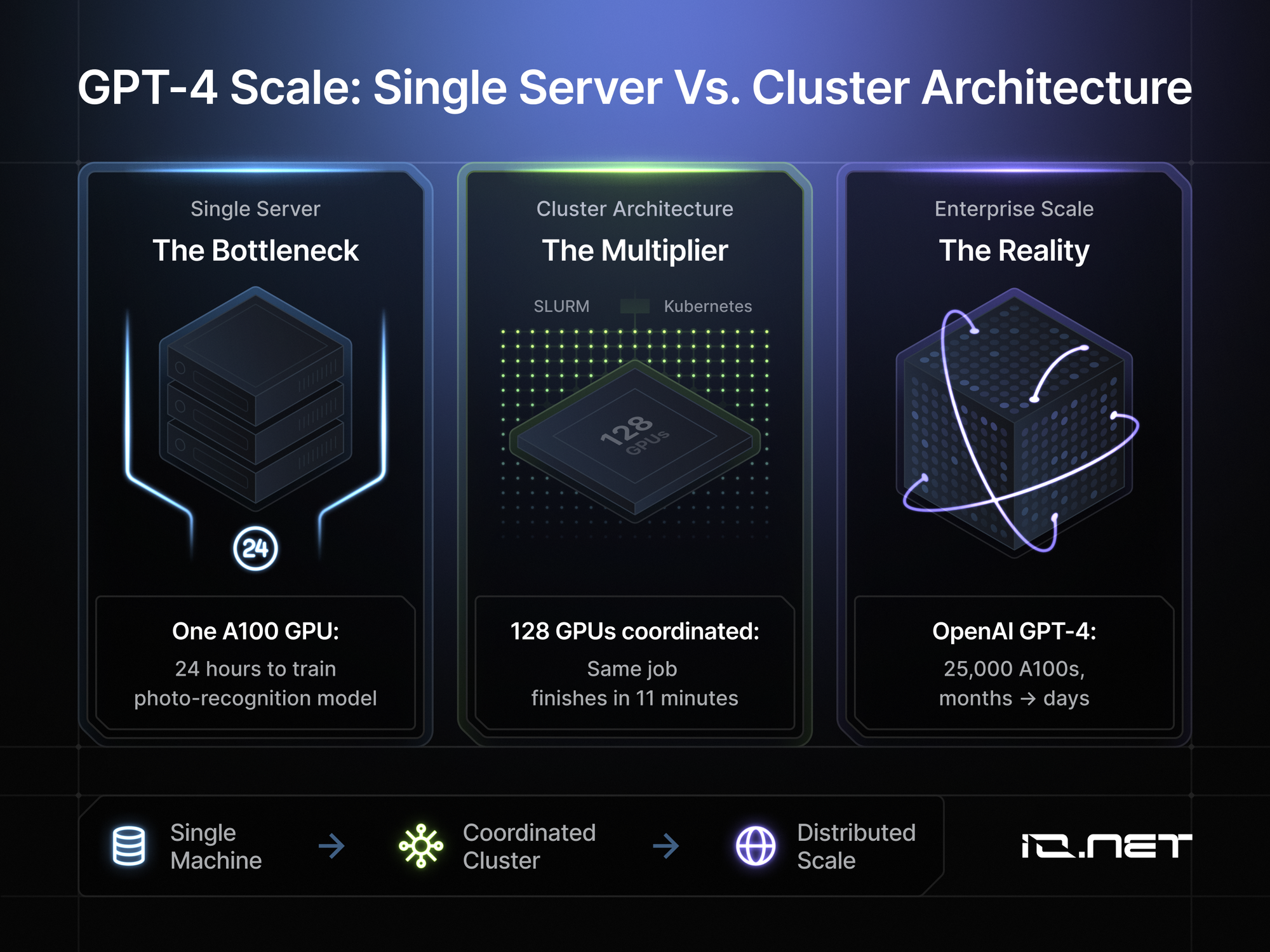

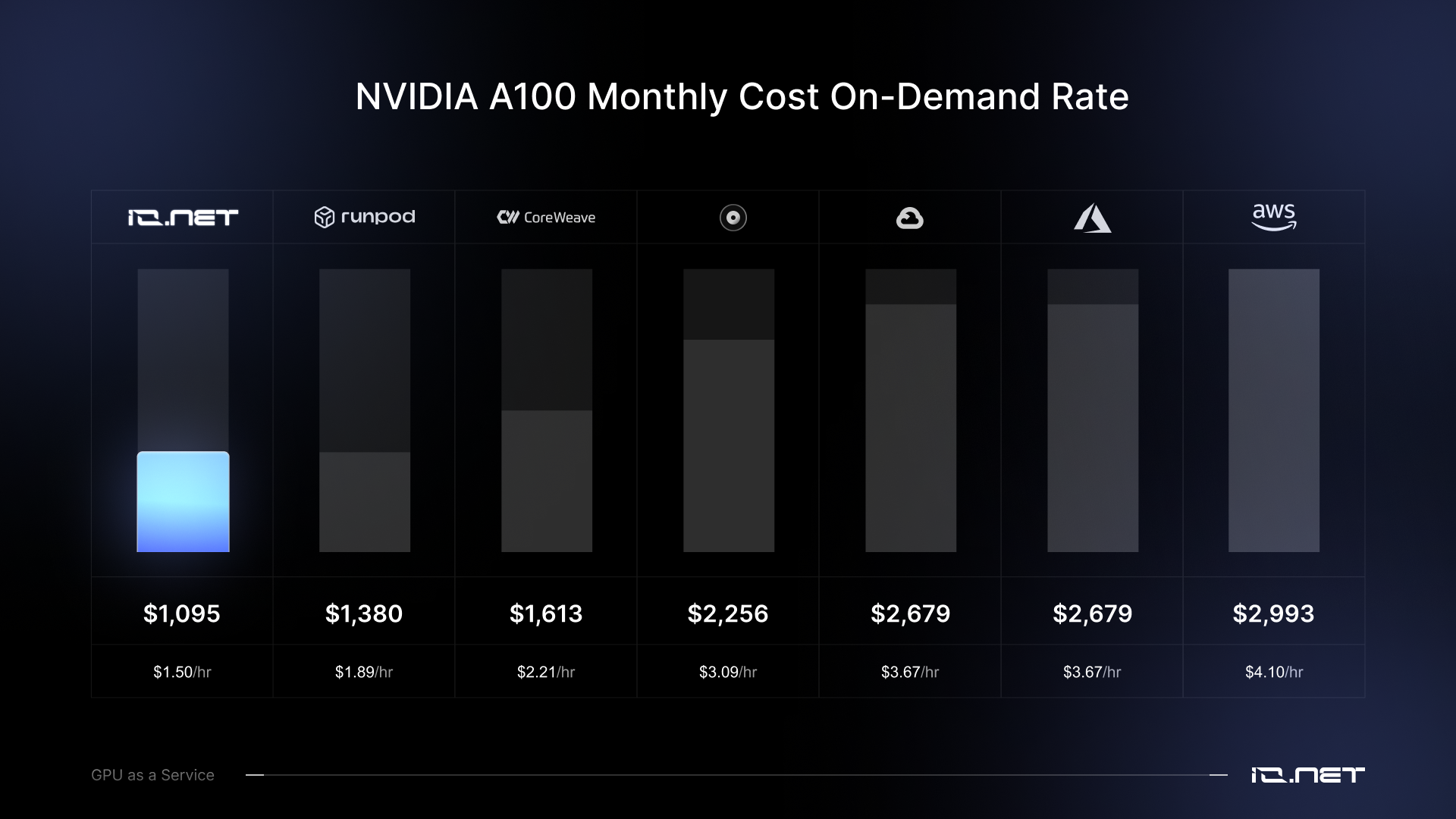

GPU Aggregation Powerhouse: io. net’s Edge in AI Workloads

io. net flips the script on fragmented GPU resources by pooling over one million units from data centers and crypto miners worldwide. This aggregation model delivers on-demand clusters in under two minutes across 130 and countries, slashing costs by up to 70% versus AWS or GCP. Purpose-built for machine learning and inference, it sidesteps the bloat of general-purpose clouds. Think H100s and MI300X GPUs benchmarked for total cost of ownership, with vendor-agnostic flexibility that lets developers spin up inference pipelines without vendor lock-in.

What sets io. net apart in decentralized GPU AI inference is its intelligent stack: automated verification tackles software compatibility, while Zero-Knowledge Proofs bolster security. For AI inference, where latency can make or break applications, io. net’s global footprint minimizes delays. Sources highlight its strategic pivot amid the AI boom, positioning it as the go-to for high-throughput tasks like model serving. Yet, this focus raises questions about versatility; io. net thrives on GPU-heavy workloads but may lag in CPU-dominant scenarios.

io. net aggregates underutilized GPU compute, offering 50-80% savings on high-end cards that cost $3-8 hourly in traditional clouds.

io.net (IO) Price Prediction 2027-2032

Forecasts driven by DePIN AI growth, GPU compute demand, and competition with Akash Network

| Year | Minimum Price | Average Price | Maximum Price | YoY Growth (Avg from Prev) |

|---|---|---|---|---|

| 2027 | $0.15 | $0.35 | $1.00 | +211% |

| 2028 | $0.25 | $0.70 | $2.50 | +100% |

| 2029 | $0.50 | $1.50 | $5.00 | +114% |

| 2030 | $0.90 | $3.00 | $10.00 | +100% |

| 2031 | $1.50 | $5.00 | $18.00 | +67% |

| 2032 | $2.50 | $8.50 | $28.00 | +70% |

Price Prediction Summary

io.net (IO) is positioned for strong long-term growth amid the AI inference boom and DePIN adoption. From a 2026 baseline of $0.1125, average prices could climb to $0.35 by 2027 and reach $8.50 by 2032 (over 75x increase), with bullish maxima up to $28.00 reflecting market cap expansion, while minima account for bearish cycles and competition.

Key Factors Affecting io.net Price

- Surging AI workloads driving demand for decentralized GPU inference

- io.net’s 1M+ GPU aggregation and 70% cost savings vs. AWS/GCP

- Enterprise shift to DePIN for flexible, secure compute

- Competition with Akash Network influencing market share

- Regulatory clarity boosting crypto infrastructure adoption

- Tech advancements like ZKPs reducing latency and enhancing security

- Alignment with crypto bull cycles and halvings

- Potential partnerships in AI ecosystem expanding use cases

Disclaimer: Cryptocurrency price predictions are speculative and based on current market analysis.

Actual prices may vary significantly due to market volatility, regulatory changes, and other factors.

Always do your own research before making investment decisions.

Akash Network’s Marketplace Mastery for Flexible Compute

Akash Network operates as a decentralized cloud marketplace, where providers bid in reverse auctions to fulfill deployments. This mechanism drives efficiency, evidenced by its 70% utilization rate and steady revenue stream. Users deploy containers and VMs across a distributed provider base, making it a public utility for diverse needs beyond just GPUs. In akash network ai gpu contexts, it shines with 60-70% savings over AWS, appealing to those prioritizing broad compute access.

The platform’s open-source ethos fosters innovation, integrating seamlessly with tools like Kubernetes for effortless scaling. Security via blockchain settlement and efficient resource matching addresses enterprise pain points. However, its generalist nature can introduce variability; auction dynamics might spike costs during peak demand, unlike io. net’s fixed aggregation pools. Still, Akash’s maturity positions it as a DePIN leader, especially for hybrid workloads blending inference with storage or general processing.

Decentralized GPU marketplaces like Akash democratize access, but io. net’s specialization could accelerate AI-specific adoption.

Head-to-Head: Latency, Cost, and Scalability Metrics

Pitting io. net decentralized GPU against Akash reveals nuanced trade-offs. io. net excels in rapid cluster spins and inference speed, critical for real-time AI like autonomous systems or recommendation engines. Its million-GPU war chest ensures scalability, with benchmarks showing superior TCO for H100 clusters. Akash counters with marketplace liquidity, boasting higher utilization and revenue proof-of-concept, ideal for cost-optimized, flexible deployments.

Cost-wise, both claim 60-80% reductions, but io. net’s GPU purity often edges out for inference-heavy users. Latency benchmarks favor io. net’s optimized routing, while Akash’s auctions introduce minor delays. Security implementations overlap in ZKPs and verification, yet io. net’s miner integration adds edge compute resilience. For enterprises eyeing AI inference DePIN platforms, io. net suits bursty GPU demands; Akash fits sustained, multi-resource needs. Market data as of February 2026 reinforces io. net’s momentum at $0.1125, signaling investor bets on its AI niche.

Scalability tests further underscore these dynamics. io. net’s aggregation scales seamlessly to massive clusters, handling inference for large language models without the bottlenecks of centralized queues. Akash, with its 736 active GPUs at 70% utilization, proves reliable for production workloads but may strain during AI hype cycles when GPU bids intensify. Enterprises must weigh these metrics against their inference cadence: bursty, high-velocity tasks favor io. net’s precision engineering.

Enterprise Use Cases: Where Each Platform Dominates

For decentralized GPU AI inference, io. net carves out leadership in latency-sensitive arenas like real-time video analytics or edge AI in autonomous vehicles. Its global deployment in 130 and countries enables low-latency inference pipelines, crucial for applications where milliseconds dictate outcomes. Developers leverage its H100 and MI300X benchmarks to optimize total cost of ownership, deploying clusters in minutes for inference serving that rivals hyperscalers at a fraction of the expense.

Akash Network, by contrast, excels in versatile enterprise stacks. Think hybrid environments blending akash network ai gpu with containerized apps, storage, and VMs. Its reverse auction model suits budgeted deployments for ongoing inference in fintech fraud detection or healthcare diagnostics, where consistent availability trumps raw speed. With $4.3 million in annual revenue, Akash demonstrates marketplace maturity, attracting providers who keep utilization humming at 70%.

io.net vs Akash Network: Key Comparison Metrics

| Metric | io.net | Akash Network |

|---|---|---|

| Number of GPUs | Over 1 million | 736 |

| Cost Savings vs Centralized Clouds | Up to 70% | 60-70% |

| Deployment Time | Under 2 minutes | Auction-based |

| Utilization | N/A | 70% |

| Annual Revenue | Emerging | $4.3M |

Both platforms mitigate traditional cloud pitfalls, yet io. net’s miner-sourced GPUs introduce edge resilience, while Akash’s open utility fosters ecosystem breadth. In DePIN AI compute networks, this duality empowers strategic diversification: pair io. net for GPU spikes, Akash for baseline capacity.

Tokenomics and Economic Incentives

io. net’s IO token at $0.1125 anchors its ecosystem, incentivizing suppliers with staking rewards and usage fees that capture AI demand. This lean model aligns with GPU scarcity, potentially amplifying value as inference workloads explode. Akash’s AKT token fuels auctions and settlements, its revenue backing long-term sustainability. At current valuations, io. net’s modest 0.0342% 24-hour uptick hints at undervaluation for pure-play AI bets, while Akash’s proven economics appeal to conservative portfolios.

Strategic foresight favors io. net for aggressive growth plays; its focus on underutilized crypto miner GPUs taps a dormant supply vein. Akash’s broader marketplace, however, hedges against AI hype deflation, offering stability in io. net decentralized GPU turbulence.

io.net vs Akash: Key Pros & Cons

-

io.net Pro: GPU Specialization – Purpose-built for GPU compute, aggregating over 1M GPUs from data centers and miners for AI workloads.

-

io.net Pro: Rapid Scaling – Deploys on-demand GPU clusters in under 2 minutes across 130+ countries.

-

io.net Pro: Cost Savings – Delivers up to 70% savings vs. AWS/GCP for AI inference.

-

io.net Con: Less Versatile – GPU-focused design limits applicability beyond specialized AI/ML tasks.

-

Akash Pro: Marketplace Efficiency – Reverse auction model enables secure, efficient buying/selling of compute resources.

-

Akash Pro: High Utilization – Achieves 70% utilization across 736 GPUs for reliable performance.

-

Akash Pro: Proven Revenue – Generates over $4.3M in annual revenue, validating marketplace model.

-

Akash Con: Auction Variability – Pricing fluctuates due to competitive bidding dynamics.

-

Akash Con: Generalist Overhead – Broader cloud support introduces complexity for pure GPU/AI inference needs.

Investors eyeing 2026 should monitor token velocity: io. net’s burn mechanisms could catalyze rallies if GPU adoption surges, echoing DePIN trends where specialized networks outpace generalists.

Risks persist across both. Network effects demand critical mass; io. net’s million-GPU claim must translate to reliable uptime, while Akash guards against bid manipulation. Regulatory scrutiny on DePIN could reshape incentives, yet blockchain primitives like ZKPs fortify their edge over centralized alternatives.

For forward-thinking leaders in AI inference DePIN platforms, the verdict tilts toward a hybrid path. io. net accelerates GPU-intensive innovation at $0.1125, embodying the AI boom’s raw potential. Akash anchors with marketplace rigor, ensuring resilient infrastructure. As decentralized compute matures, blending these forces will define scalable AI sovereignty, outmaneuvering legacy clouds in the 2026 landscape.

Explore how these networks cut inference costs dramatically.