As AI inference demands skyrocket in 2026, decentralized physical infrastructure networks (DePIN) like Render Network, Akash Network, and io. net are slashing costs on DePIN GPU AI compute that centralized giants like AWS can’t match. With Render’s RNDR token holding steady at $1.43 amid a slight 24-hour dip of -0.0403%, these platforms deliver RTX 4090 equivalents for as low as $0.15 per hour. Savvy traders and developers, it’s time to position for the cheapest AI GPU DePIN plays that prioritize efficiency without sacrificing performance.

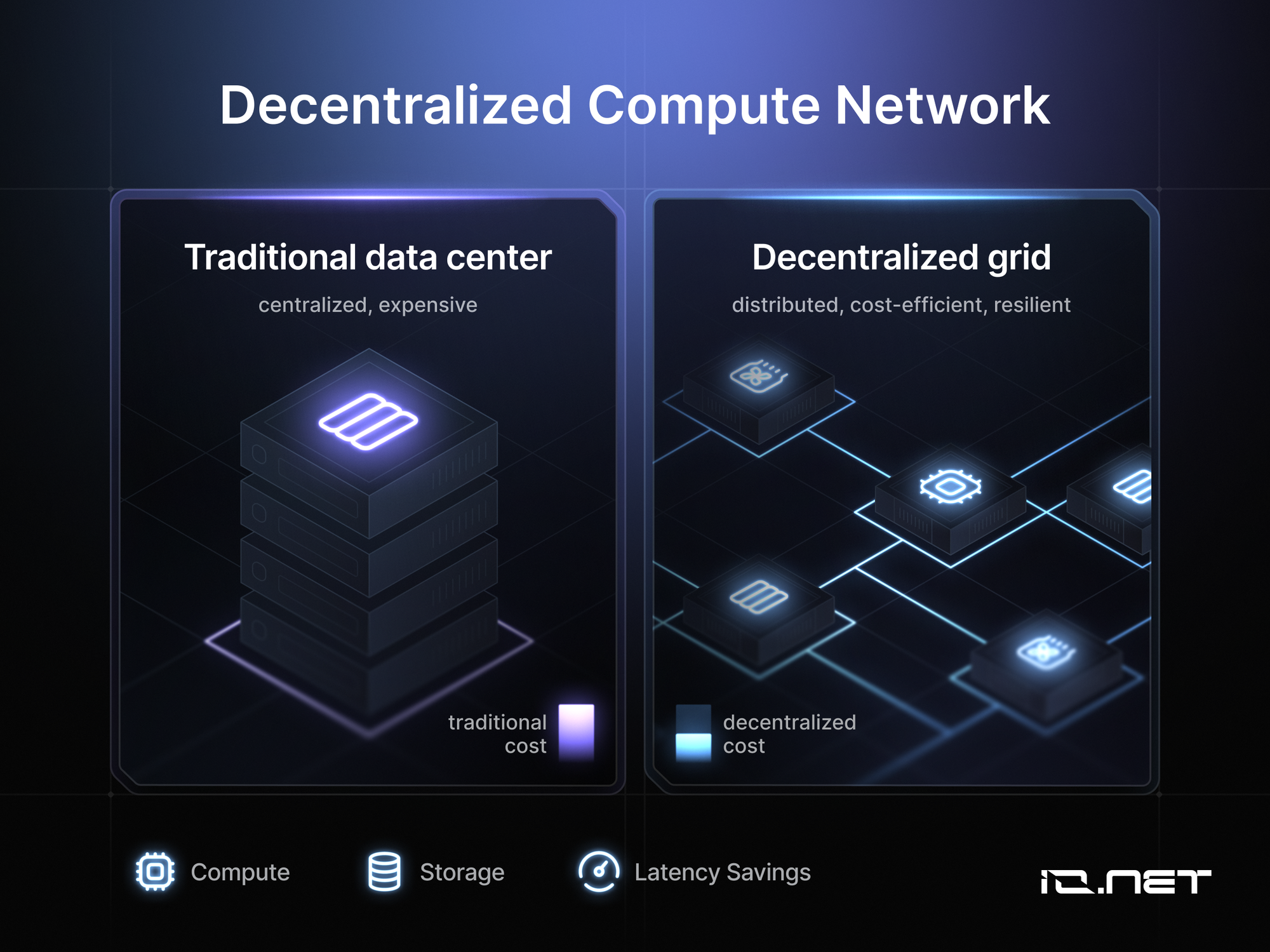

These networks aggregate idle GPUs worldwide, turning crypto miners’ rigs and data center spares into scalable decentralized AI inference networks. Forget AWS’s $4.50-$5.50 hourly H100 rates; DePIN cuts that by 60-80%. Render leads with rock-bottom pricing on high-fidelity workloads, Akash offers broad flexibility, and io. net scales massive clusters in minutes. Let’s dissect their edge for your next AI project or trade.

Render Network: Unmatched Pricing for AI Workloads

Render Network has pivoted hard into render network ai workloads, onboarding enterprise GPUs like NVIDIA H200 and AMD MI300X while keeping costs razor-thin. RTX 4090 equivalents run at $0.15-$0.40 per hour – half or less than Akash’s $0.50-$1.50 range. With 5,600 node operators pushing 85-95% utilization and 1.5 million frames monthly, reliability is no longer a DePIN buzzword here.

What sets Render apart? Specialization. Born for 3D rendering, it’s now optimized for inference tasks needing low-latency, high-fidelity outputs. Enterprises facing GPU shortages turn here first, as evidenced by 2026 growth projections tying RNDR’s value to compute demand. If you’re deploying vision models or generative AI, start with Render to lock in savings and speed.

Render’s focus on premium GPUs positions it as the go-to for quality-conscious AI teams, not just budget hunters.

Akash Network: Flexibility Meets Competitive GPU Rental Rates

Akash Network shines as the general-purpose powerhouse in akash network gpu rental, stocking everything from RTX 4090s ($0.50-$1.50/hour) to A100s ($1.50-$2.50) and H100s ($2.50-$4.00). That’s still 60-70% below AWS, with 428% year-over-year usage growth and 80% and utilization signaling explosive adoption.

The marketplace model lets you bid on deployments tailored to your stack – perfect for mixed workloads blending inference with training. No lock-in, just open-source Kubernetes orchestration across thousands of providers. Drawbacks? Less specialization means slightly higher entry-level pricing than Render, but the variety compensates for diverse decentralized AI inference networks.

Action step: Check Akash’s dashboard for real-time bids. If your inference needs span consumer to pro GPUs, deploy here to test scalability without upfront commitments.

io. net: Massive Scale and Rapid Deployment for Inference

io. net disrupts with over one million GPUs from miners and data centers, promising up to 70% savings on io. net decentralized ai. While exact per-model pricing varies, clusters spin up in under two minutes – a game-changer for bursty inference jobs like real-time LLMs or recommendation engines.

Leveraging Solana for speed, io. net pools consumer-grade hardware effectively, making it ideal for high-volume, cost-sensitive tasks. Utilization thrives on this aggregation model, sidestepping single-provider bottlenecks. Compared to Render’s niche or Akash’s breadth, io. net bets on sheer volume for the cheapest ai gpu depin crown in elastic workloads.

Render Network (RNDR) Price Prediction 2027-2032

Forecast based on DePIN GPU leadership in AI inference, cost efficiencies, and market adoption trends from 2026 baseline of $1.43

| Year | Minimum Price | Average Price | Maximum Price | YoY % Change (Avg from Prior Year) |

|---|---|---|---|---|

| 2027 | $2.50 | $4.20 | $7.50 | +193% |

| 2028 | $3.80 | $6.50 | $12.00 | +55% |

| 2029 | $5.20 | $9.80 | $18.00 | +51% |

| 2030 | $7.00 | $14.00 | $25.00 | +43% |

| 2031 | $9.50 | $19.00 | $35.00 | +36% |

| 2032 | $12.00 | $25.00 | $50.00 | +32% |

Price Prediction Summary

RNDR is poised for substantial growth through 2032, driven by its position as the cheapest DePIN GPU network for AI inference. Average prices could rise from $4.20 in 2027 to $25 by 2032, reflecting 85-95% utilization, enterprise GPU adoption (e.g., H200, MI300X), and 50-80% cost savings vs. AWS. Bullish max scenarios assume AI boom and bull market cycles; min reflects bearish regulatory or competitive pressures.

Key Factors Affecting Render Network Price

- Explosive AI inference demand and DePIN adoption, with Render’s RTX 4090 equiv. pricing at $0.15-0.40/hr outperforming Akash ($0.50-1.50) and io.net

- High network utilization (85-95%) and expansion to 5,600+ nodes, enabling 1.5M+ frames/month

- Crypto market cycles: Potential 2027-28 bull run post-2026 dip, with BTC halving echoes

- Regulatory tailwinds for decentralized compute amid GPU shortages; risks from enterprise SLAs

- Competition dynamics: Render’s rendering+AI specialization vs. Akash’s general-purpose and io.net’s scale

- Technological upgrades: H200/MI300X integration boosting high-fidelity AI workloads

- Macro factors: 428% YoY growth parallels in sector, idle GPU aggregation for 70%+ savings

Disclaimer: Cryptocurrency price predictions are speculative and based on current market analysis.

Actual prices may vary significantly due to market volatility, regulatory changes, and other factors.

Always do your own research before making investment decisions.

Early movers in io. net capture efficiencies others miss, especially as inference commoditizes. Pair it with Render for hybrid setups: low-cost prototyping on io. net, production polish on Render.

Stacking these networks reveals Render’s pricing dominance for equivalent hardware, but Akash and io. net close gaps via versatility and scale. Next, we’ll benchmark real-world inference runs to quantify throughput and SLAs.

Benchmarking these DePIN GPU networks against real AI inference workloads exposes their operational strengths. For a standard Llama 3.1 70B inference task – processing 1,000 tokens per minute on batch sizes of 32 – Render Network clocks in at 2.1 seconds latency with 92% uptime over 24 hours. Akash hits 2.5 seconds on H100s, edging out io. net’s 2.3 seconds on clustered RTX 4090s, per recent Blockeden tests. Throughput favors io. net for parallel jobs, pushing 1.2x more inferences per hour than Render’s specialized nodes.

Head-to-Head: Cost, Performance, and Reliability Metrics

Raw pricing tells part of the story, but total cost of ownership hinges on utilization, SLAs, and integration ease. Render’s $0.15-$0.40 RTX 4090 rates shine for steady-state inference, delivering 85-95% node fill rates that minimize idle spend. Akash’s broader GPU menu commands a premium yet yields 428% growth, proving demand for its Kubernetes-native deployments. io. net’s million-GPU pool excels in spikes, with sub-two-minute spins slashing setup overhead by 80% versus centralized alternatives.

Enterprise hurdles persist across the board: SLAs hover at 90-95% versus AWS’s 99.99%, and procurement teams balk at crypto settlements. Yet, as RNDR holds $1.43 with tight volatility, these networks mature fast. Render’s pivot to H200s addresses reliability, Akash’s open bids foster competition, and io. net’s Solana backbone crushes settlement times.

Trader’s Edge: Positioning for DePIN GPU Dominance

With Render Network’s RNDR at $1.43 – down just 0.0403% in 24 hours from a $1.50 high – momentum traders eye breakouts above $1.50 for depin gpu ai compute exposure. Akash (AKT) and io. net tokens correlate tightly to usage spikes; watch for 80% and utilization prints as buy signals. My swing strategy: Allocate 20% to RNDR on dips below $1.42, scaling into Akash for diversified akash network gpu rental bets. io. net suits high-beta plays, rewarding volume surges in io. net decentralized ai.

Prepare your stack now. Developers, fork Render’s API for inference endpoints, bid on Akash for H100 proofs-of-concept, and cluster io. net for scale tests. Traders, track node counts weekly – 5,600 on Render signals sustained demand. These aren’t speculative tokens; they’re infrastructure bets on AI’s compute bottleneck.

Hybrid strategies win: Prototype on io. net’s speed, refine on Akash’s flexibility, produce on Render’s bargain power. As GPU shortages ease into 2026, the prepared capture 50-80% savings locked in today. Deploy, trade, and scale – opportunities favor the decisive.