In 2026, AI inference dominates compute demands, consuming over 55% of total AI spend as always-on workloads strain centralized clouds with latency and escalating costs. Decentralized GPU DePIN networks like Akash and Gensyn emerge as viable alternatives, pooling global GPU resources on blockchain for scalable, cost-effective AI inference decentralized networks. This comparison dissects their architectures, performance, and trajectories in the burgeoning decentralized GPU DePIN AI landscape.

Akash Network’s Mature GPU Marketplace for Inference

Akash Network stands as a battle-tested compute coordination layer, mirroring AWS EC2 but with permissionless deployment and reverse auction pricing that drives costs sub-$1 per GPU hour in many cases. As of January 29,2026, AKT trades at $0.4484, down 0.5170% over 24 hours with a high of $0.4757 and low of $0.4453. Its diverse hardware pool spans 17,700 CPUs alongside growing GPU inventory, now targeting over 1,200 active GPUs by year-end, doubling prior capacity.

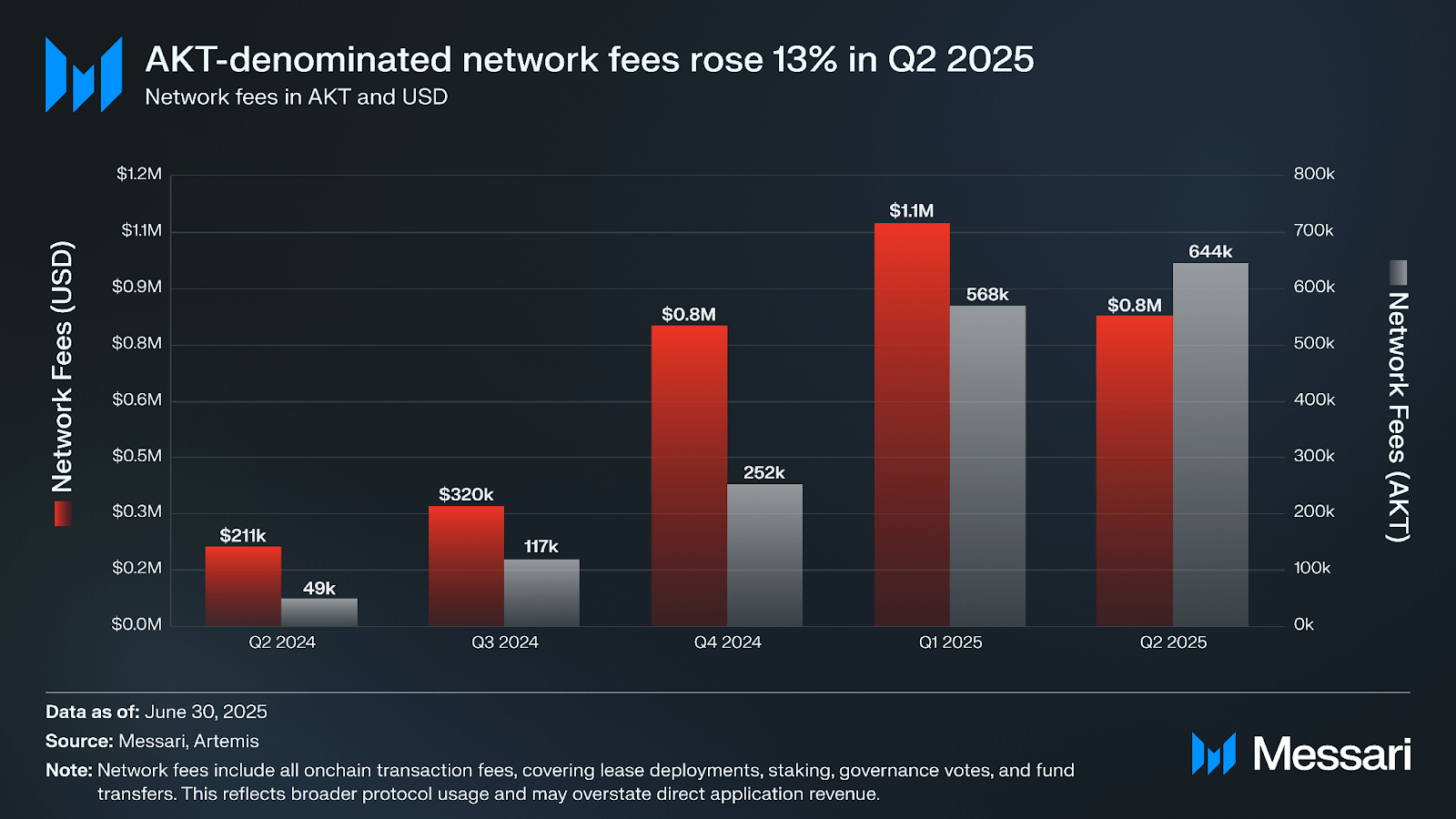

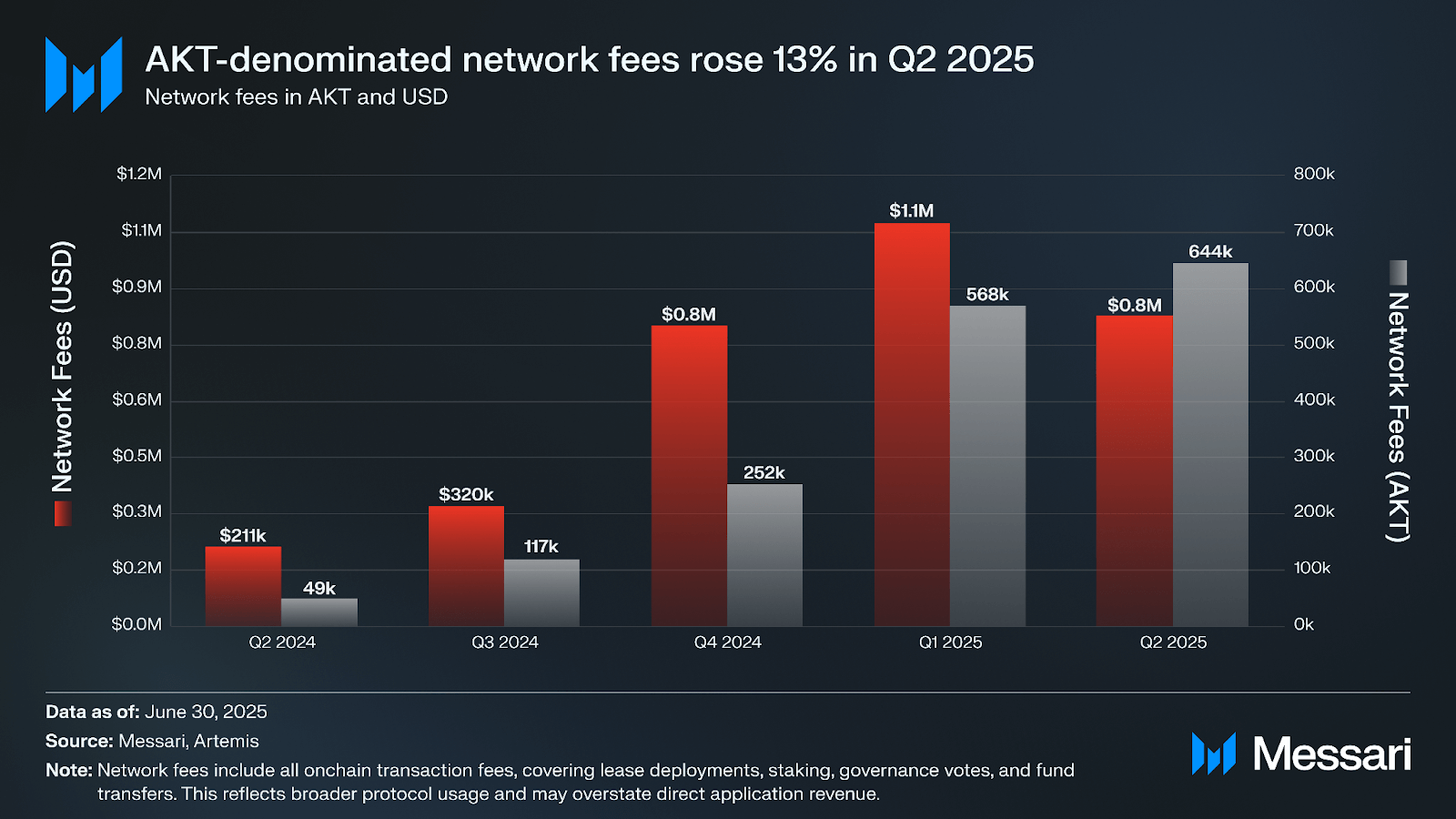

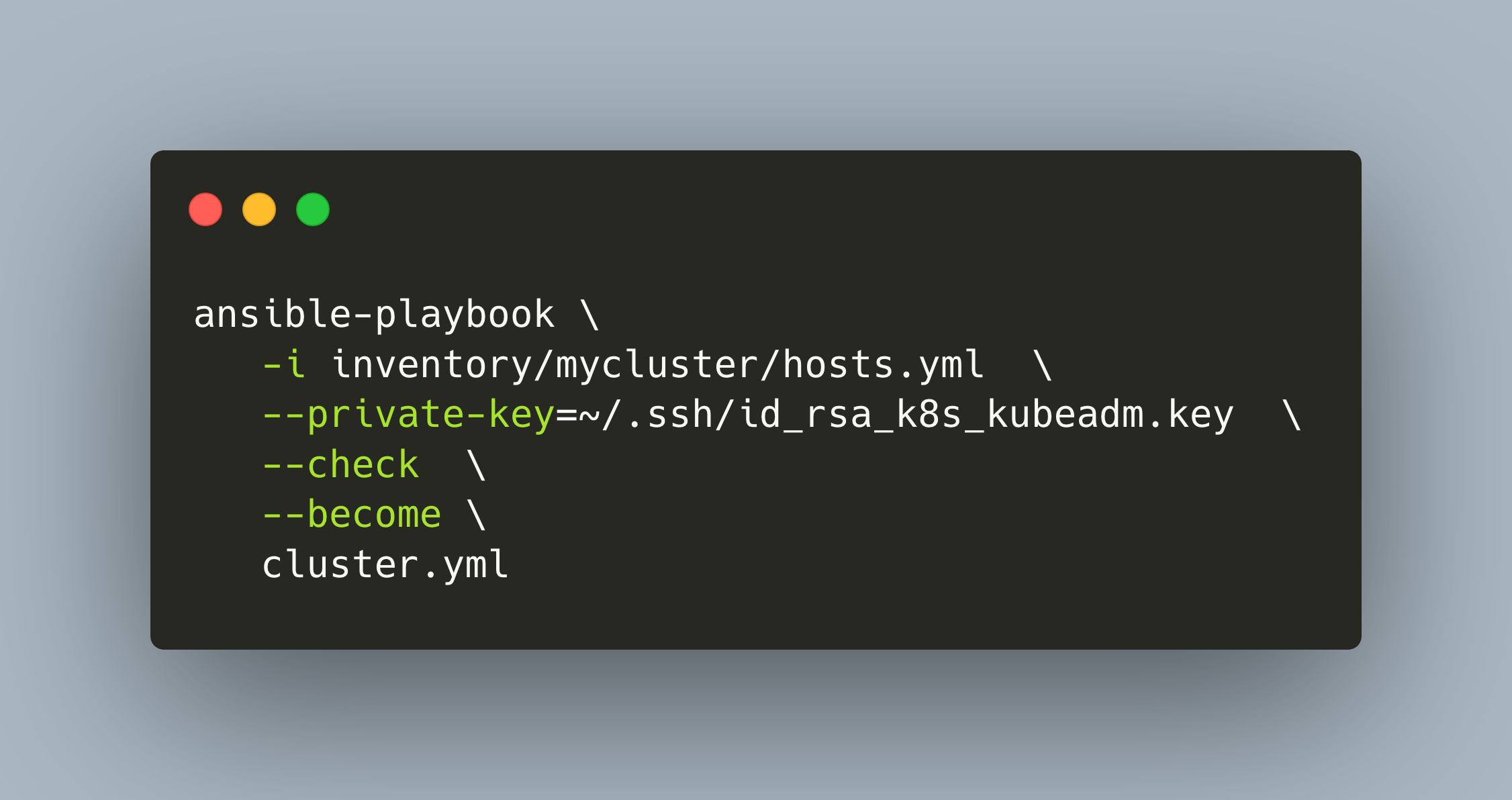

Akash’s strength lies in its general-purpose appeal, supporting Akash network AI inference via NVIDIA H100 GPUs and integrations like the May 2025 deployment of Gensyn RL-Swarm nodes. Providers bid competitively, ensuring efficient resource matching for inference tasks from edge devices to enterprise clusters. Data from Messari’s Q2 2025 report underscores this momentum: Akash’s GPU marketplace has onboarded enterprise-grade hardware, enabling seamless decentralized execution of RL models and beyond. In practice, developers deploy Kubernetes-native deployments in minutes, bypassing cloud vendor lock-in while tapping idle GPUs worldwide.

Financially, Akash’s trajectory impresses. Analysts forecast AKT reaching $3.00 to $8.97 by 2026’s close, fueled by surging demand for DePIN GPU marketplaces 2026. Its tokenomics incentivize providers through AKT staking and rewards, fostering network effects as utilization climbs.

Akash Network (AKT) Price Prediction 2027-2032

Forecasts based on DePIN GPU growth for AI inference, Akash’s market leadership vs. Gensyn, and crypto market cycles (from 2026 baseline avg ~$6)

| Year | Minimum Price | Average Price | Maximum Price | YoY % Change (Avg from Prior Year) |

|---|---|---|---|---|

| 2027 | $3.50 | $9.00 | $16.00 | +50% |

| 2028 | $5.00 | $14.00 | $25.00 | +56% |

| 2029 | $8.00 | $22.00 | $40.00 | +57% |

| 2030 | $12.00 | $35.00 | $65.00 | +59% |

| 2031 | $18.00 | $55.00 | $100.00 | +57% |

| 2032 | $25.00 | $85.00 | $150.00 | +55% |

Price Prediction Summary

AKT is forecasted to experience robust growth driven by AI inference demand and DePIN expansion, with average prices rising from $9 in 2027 to $85 by 2032. Bullish scenarios reflect adoption surges and market cycles, while mins account for competition and bears.

Key Factors Affecting Akash Network Price

- AI inference boom (55%+ of compute spend shifting to DePIN GPUs)

- Akash’s mature infrastructure and GPU doubling to 1,200+ units

- Integrations like Gensyn nodes on NVIDIA H100 GPUs via Akash

- Superior scalability vs. early-stage competitors (Gensyn, io.net, Render)

- Crypto market cycles with post-2028 bull potential

- Regulatory clarity boosting DePIN adoption

- Rising enterprise demand for cost-effective decentralized compute

Disclaimer: Cryptocurrency price predictions are speculative and based on current market analysis.

Actual prices may vary significantly due to market volatility, regulatory changes, and other factors.

Always do your own research before making investment decisions.

Gensyn Network’s Specialized Protocols for AI Compute

Gensyn Network carves a niche with protocols engineered for AI workloads, particularly machine learning training but extending to inference via Probabilistic Proof-of-Learning and Graph-based Pinpoint Protocol. Still in Devnet as of early 2026, it lacks public metrics on network scale, positioning it behind Akash in maturity. Yet, its focus on verifiable compute promises tamper-proof execution, critical for high-stakes Gensyn AI compute DePIN.

Unlike Akash’s broad marketplace, Gensyn emphasizes enterprise-grade GPUs, linking hardware to on-chain rewards with precision. Sources like Reflexivity Research highlight how it leverages excess compute diversely, potentially slashing costs for inference pipelines. A key differentiator: while Akash handles general cloud tasks, Gensyn’s tech stack verifies learning outcomes at the node level, mitigating sybil attacks in decentralized settings. Gate. com notes Gensyn’s training specialization contrasts Akash’s inference tilt, but as inference eclipses training spend, Gensyn’s adaptability could shine.

Head-to-Head: Infrastructure, Incentives, and Inference Edge

Pitting Akash against Gensyn reveals stark maturity gaps. Akash boasts operational scale with active providers and deployments, per TokenInsight’s overview of DePIN x AI projects; its CPU-GPU-storage trifecta suits comprehensive inference stacks. Gensyn, per DFG Official’s analysis, prioritizes high-end GPUs like Aethir but trails in deployment readiness.

| Metric | Akash | Gensyn |

|---|---|---|

| Maturity | Mainnet, 1,200 and GPUs targeted | Devnet, no public stats |

| Focus | General compute and inference | AI training and verifiable inference |

| Token Price (2026) | $0.4484 | N/A (pre-mainnet) |

| USP | Reverse auctions, Kubernetes | Proof-of-Learning protocols |

Akash’s permissionless model accelerates adoption, as Spydra’s decentralized compute breakdown affirms: its GPU marketplace rivals centralized giants on price while decentralizing control. Gensyn’s innovation, however, could disrupt once live; imagine inference jobs proven correct via blockchain, slashing fraud risks in AI inference decentralized networks. Market data tilts toward Akash for now, but Gensyn’s testnet integrations on Akash hint at symbiotic futures in depin GPU marketplaces 2026.

Throughput metrics further favor Akash: its network handles diverse workloads with sub-second bidding, per AIxBlock comparisons. Gensyn’s protocols, while elegant, demand node sophistication that may slow bootstrapping. For developers eyeing 2026 inference booms, Akash offers plug-and-play reliability; Gensyn tempts with cutting-edge security for mission-critical apps.

Enterprise teams running real-time inference for recommendation engines or autonomous systems find Akash’s marketplace indispensable, with deployments scaling from single H100s to clusters without procurement hassles. Gensyn’s verifiable proofs suit regulated sectors like healthcare AI, where audit trails matter more than raw speed.

Akash vs Gensyn: AI Inference Workloads Comparison 2026

| Metric | Akash | Gensyn |

|---|---|---|

| Latency | Low latency shines for inference & edge AI 🚀 (Messari Q2 2025 benchmarks) | Bandwidth-heavy focus 📡, unproven in production |

| Cost vs AWS Spot | 40% savings 💰, sub-$1/GPU-hr (AIxBlock, Reflexivity) | Simulated Devnet pricing only, TBD post-mainnet |

| Kubernetes Compatibility | Full K8s support ✅ (mature marketplace) | Limited – custom protocols (Probabilistic Proof-of-Learning) |

| Workload Focus | Inference priority: Stable Diffusion, edge AI (Gate.com, 55%+ inference era) | Training-to-inference pipelines (Reflexivity) |

| Maturity | Established leader, supports Gensyn nodes (Messari May 2025) | Devnet constraints, no public stats (HKDCA 2026) |

| GPU Availability (2026 Proj.) | >1,200 active GPUs 📈 (Cache256) | Early dev, infrastructure developing |

| Market Position | Diverse hardware incl. NVIDIA H100, AKT $0.4484 (Jan 2026) | Innovative protocols, impact post-deployment |

Consider edge AI: Akash providers near data sources cut transport latency, vital as inference spend hits 55% of AI budgets per industry observers. Gensyn’s Graph-based protocol could excel in distributed fine-tuning, but without mainnet throughput data, it remains theoretical. Developers prioritizing cost savings flock to Akash’s reverse auctions; those betting on protocol innovation eye Gensyn’s post-launch potential.

Akash’s Key DePIN GPU Advantages 2026

-

Permissionless Access: Anyone can deploy compute resources without approval, enabling open participation in the marketplace.

-

Sub-$1 GPU Hours: Reverse auction pricing delivers GPU compute at under $1 per hour, far below centralized clouds.

-

1,200+ GPUs Targeted: Network aims to double active GPUs to over 1,200 by 2026 for scalable AI inference.

-

Kubernetes Native: Built-in support for Kubernetes orchestration simplifies deployments and scaling.

-

Proven Inference Scale: Mature infrastructure with real-world AI inference, including H100 GPU support for Gensyn nodes.

Tokenomics and Provider Incentives

Akash’s AKT at $0.4484 underpins a robust economy: providers stake tokens for bids, earning yields as utilization rises toward 1,200 GPUs. This aligns supply with exploding inference demand, per TokenInsight’s DePIN x AI analysis. Gensyn, pre-token launch, hints at similar reward mechanisms tied to proof-of-learning verifications, potentially offering higher yields to offset risks.

| Incentive Model | Akash (AKT $0.4484) | Gensyn |

|---|---|---|

| Staking Rewards | Provider bids via AKT, 5-15% APY | Proof-verified payouts (TBD) |

| Supply Growth | 17,700 CPUs and GPU ramp-up | Enterprise GPUs focus, Devnet |

| Demand Driver | Inference auctions | Verifiable AI tasks |

| 2026 Projection | $3-$8.97 AKT upside | Mainnet token debut |

Akash’s model bootstraps liquidity; every inference job circulates AKT, amplifying network value. Gensyn’s approach, per Decentralised. co insights on token incentives, could premium-price verified compute, attracting quality providers over volume.

Risks temper enthusiasm. Akash faces commoditization as rivals like io. net and Render flood the market, per Impossible Finance’s Aethir report. Gensyn risks delays, with Devnet signaling execution hurdles amid fierce decentralized GPU DePIN AI competition. Yet, synergies emerge: Akash’s 2025 Gensyn node support foreshadows hybrid ecosystems.

For builders, Akash delivers immediate Akash network AI inference wins – deploy today, scale tomorrow. Gensyn appeals to visionaries chasing Gensyn AI compute DePIN purity, where blockchain verifies every flop. As centralized clouds falter under inference loads, these networks redefine GPU access, blending crypto economics with AI scale. Pick Akash for production; monitor Gensyn for disruption.