In 2025, the decentralized AI compute landscape is being fundamentally reshaped by the rise of real-time GPU markets within DePIN (Decentralized Physical Infrastructure Networks). As the market capitalization of DePIN projects surpasses $30 billion, and with forecasts pointing toward a $50 billion valuation by year-end, the conversation around compute liquidity has moved from speculative theory to operational reality. Real-time marketplaces for GPU resources are emerging as pivotal infrastructure, enabling scalable, cost-efficient, and democratized access to high-performance compute for AI developers and enterprises alike.

The Dawn of Real-Time GPU Marketplaces

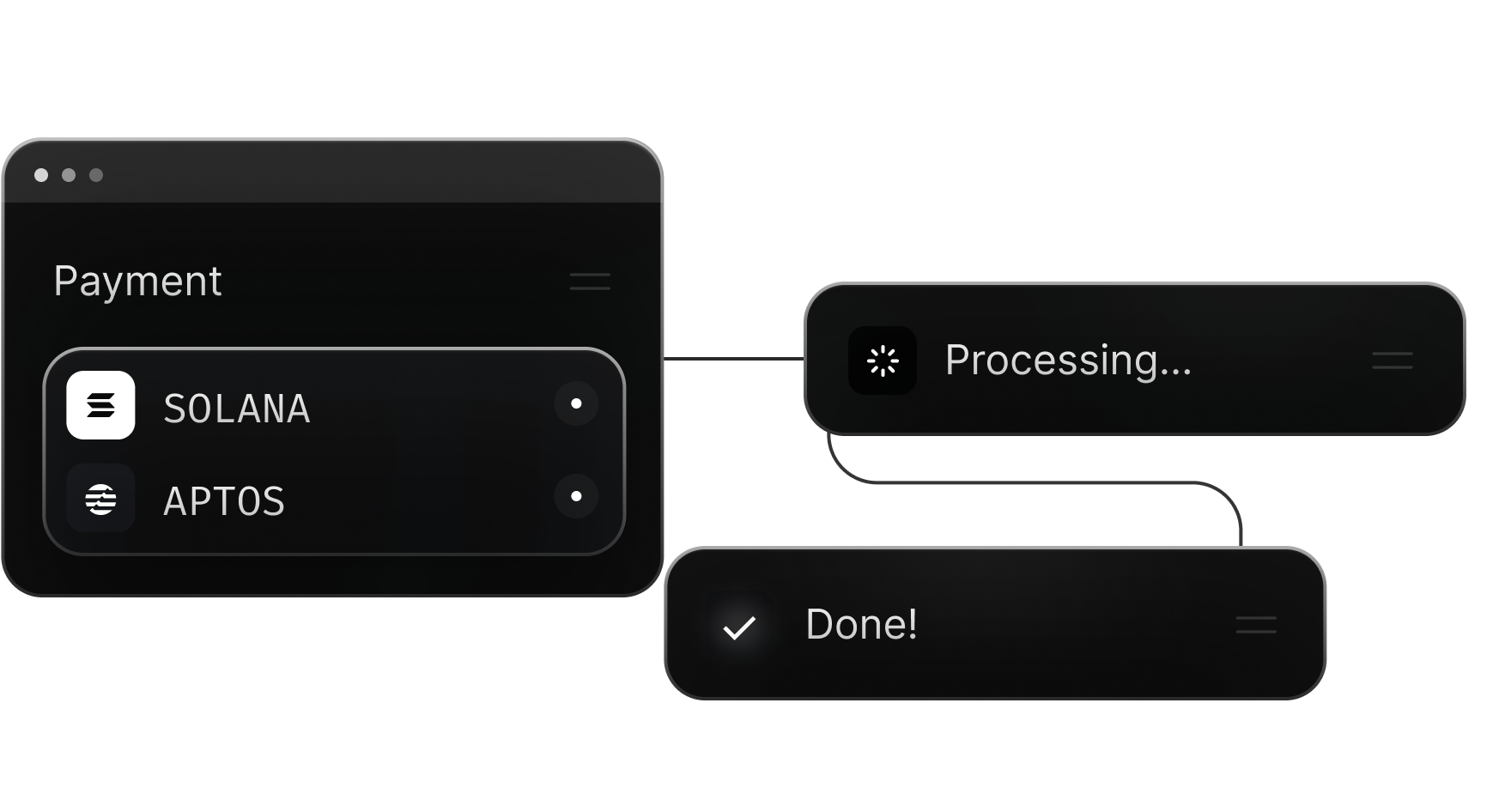

The traditional model of centralized cloud computing is rapidly ceding ground to a new paradigm: decentralized networks that aggregate idle GPUs from across the globe. Platforms like io. net, valued at $272 million, have become critical players by offering a dynamic marketplace where both GPU and CPU resources are matched in real time with machine learning workloads. This approach not only optimizes hardware utilization but also introduces price discovery mechanisms that reflect true supply and demand conditions.

Nosana, with its $54 million market cap, exemplifies this shift. Since launching its GPU marketplace in January 2025, Nosana has seen an explosion in daily active nodes as both independent developers and enterprise teams migrate away from opaque pricing structures of legacy cloud providers. Meanwhile, Render Network, having completed its migration to Solana and supporting a robust $3.21 billion market cap, leverages blockchain speed and transparency to deliver faster rendering services at lower costs, an essential capability for composable AI compute networks.

Compute Liquidity: The New Frontier for Decentralized AI

At the heart of these innovations lies the concept of compute liquidity: the ability to instantly provision, scale, or release GPU resources as application needs fluctuate. In practice, this means that AI projects can now tap into a global pool of tokenized compute power, paying only for what they use and avoiding costly over-provisioning. This flexibility is especially valuable as post-training techniques become more sophisticated and inference workloads spike unpredictably.

The impact on cost efficiency cannot be overstated. By leveraging underutilized GPUs scattered across consumer devices, data centers, and edge locations, DePIN platforms are slashing compute costs by up to 70% compared to traditional cloud offerings. For startups building next-generation AI agents or enterprises running production-scale inference engines, this represents a direct boost to margins, and a strategic hedge against future hardware shortages.

Security and Transparency: Trustless Compute at Scale

The decentralization of physical infrastructure brings more than just economic benefits, it fundamentally enhances security and transparency in AI compute workflows. Unlike centralized providers where outages or breaches can cripple operations overnight, distributed networks minimize single points of failure by spreading workloads across thousands of independently operated nodes.

This distributed architecture also enables verifiable computation: developers can monitor node status, task progress, and even real-time GPU utilization through open dashboards rather than relying on black-box assurances from cloud giants. The result is an ecosystem where trust is engineered into the protocol layer, empowering both builders and investors with greater confidence in network reliability.

If you’re looking to dive deeper into how decentralized GPU networks are transforming cost structures for scalable AI inference, including case studies on EdgeAI, check out our in-depth analysis here.

As we look ahead, the competitive advantages of real-time GPU marketplaces are becoming increasingly clear. Not only do they unlock composable AI compute networks, but they also enable a new breed of applications that would have been cost-prohibitive or technically unfeasible just a few years ago. The ability to combine, split, and route workloads across a decentralized mesh of GPU providers is fueling rapid experimentation in generative AI, large language models, and edge-based intelligence.

Top DePIN Projects Shaping Compute Liquidity in 2025

-

Render Network: With a market capitalization of $3.21 billion (as of 2024), Render Network stands as a pioneer in decentralized GPU computing. Its migration to Solana has enabled faster, more scalable, and cost-effective rendering for AI and graphics workloads, making it a cornerstone of the DePIN ecosystem.

-

io.net: Backed by Multicoin Capital and Solana Ventures, io.net operates a leading decentralized compute marketplace. With a $272 million market cap and a recent $30 million Series A funding round, io.net supplies real-time GPU and CPU resources to AI developers worldwide.

-

Nosana: Focused on AI inference, Nosana delivers decentralized GPU power with a market capitalization of $54 million. Since launching its GPU marketplace in January 2025, Nosana has seen rapid growth in daily active nodes, catering to both enterprise and independent developers.

-

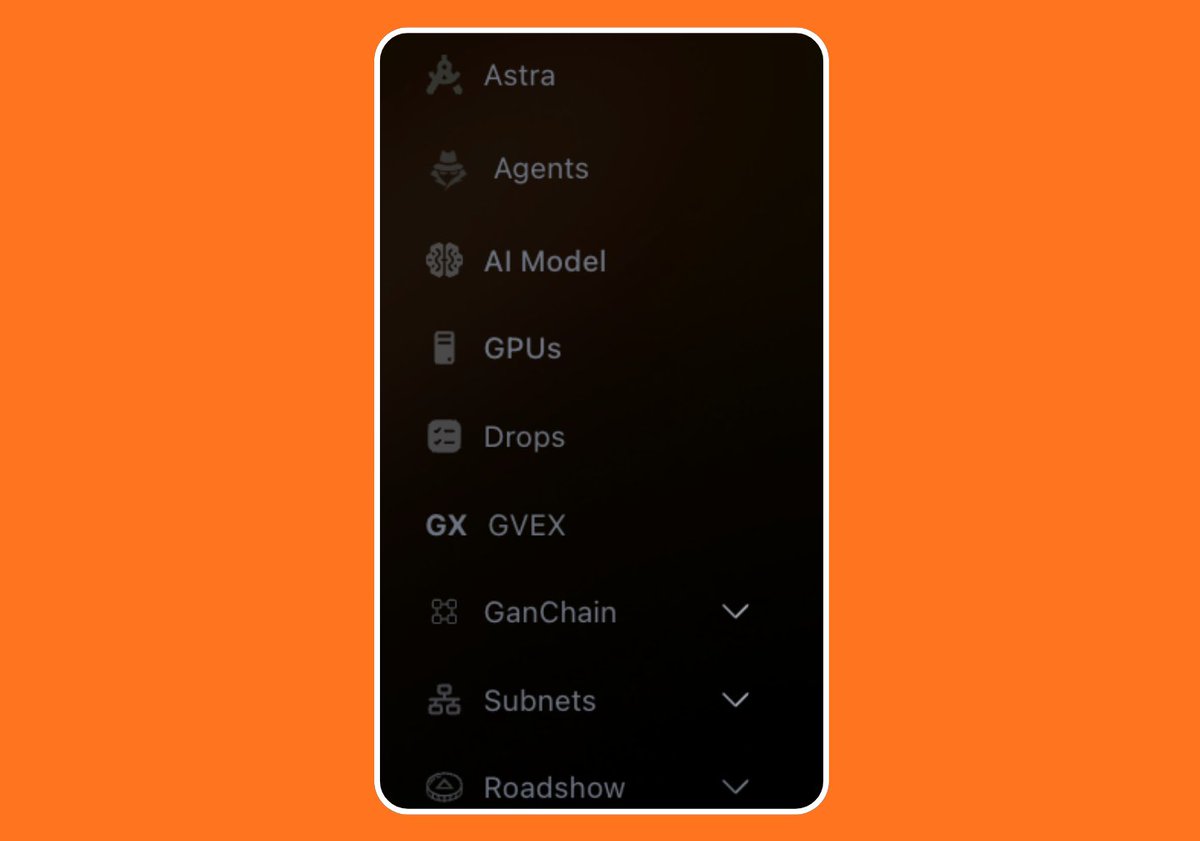

Planck: As an AI-native Layer-0 and GPU-native Layer-1 network, Planck merges blockchain and AI to provide decentralized, high-performance compute infrastructure. Its focus on affordability and scalability is attracting a growing developer community.

-

GPU.net: Known for its innovative Subnet architecture, GPU.net aggregates idle GPUs globally, offering real-time, scalable, and cost-effective compute for AI workloads. Its role in revolutionizing decentralized GPU markets is widely recognized in the DePIN sector.

Perhaps most importantly, these developments are democratizing access to high-performance AI infrastructure. No longer confined to the budgets of Fortune 500 companies, powerful GPU resources are now available to independent researchers, startups in emerging markets, and open-source communities. The result? A more inclusive innovation cycle where talent and creativity, not capital, set the pace for progress.

However, this decentralization brings its own set of challenges. Network reliability depends on robust incentive structures and sophisticated reputation systems for node operators. Projects like Planck are addressing these gaps by merging AI-native protocols with blockchain consensus, ensuring that compute supply remains both abundant and trustworthy even as demand surges globally.

Tokenization: Powering the Next Phase of Compute Liquidity

The tokenization of GPU compute is central to this evolution. By representing compute capacity as tradable digital assets, DePIN platforms create liquid markets where pricing responds instantly to shifts in utilization or hardware availability. This not only benefits buyers seeking affordable resources but also incentivizes hardware owners, from gamers with idle GPUs to enterprise data centers, to contribute spare capacity for financial rewards.

On-chain settlement further enhances transparency: every transaction is recorded on an immutable ledger, allowing users to audit historical performance and costs down to the last tokenized microsecond of computation. As regulatory clarity improves and interoperability standards mature across networks like io. net ($272 million market cap), Nosana ($54 million), and Render Network ($3.21 billion), expect even greater convergence between DePIN-native tokens and mainstream crypto capital flows.

This shift toward programmable liquidity is already impacting developer behavior. Instead of being locked into long-term contracts or proprietary APIs, teams can now architect AI pipelines that automatically source the best-priced compute from multiple networks, adapting in real time as market conditions change. The upshot is a more resilient ecosystem where supply shocks (like those seen during past hardware shortages) can be absorbed by tapping global reserves at a moment’s notice.

What Comes Next for Decentralized AI Compute?

The trajectory for decentralized AI compute in 2025 is clear: more liquidity, more composability, and more user empowerment at every layer of the stack. As DePIN platforms continue scaling beyond $30 billion, and toward $50 billion as projected, their impact will extend far beyond cost savings alone.

We’re entering an era where real-time GPU marketplaces underpin not just technical infrastructure but also new forms of economic coordination between hardware owners, developers, investors, and end users. For those building or investing in this space today, understanding how tokenized GPU marketplaces work isn’t just optional, it’s essential strategic knowledge.

If you want to explore how these trends intersect with scalable inference engines or verifiable compute at scale, our coverage on verifiable AI inference provides actionable insights for both technical architects and forward-thinking investors.